Weekly Roundup, 3rd September 2019

We begin today’s Weekly Roundup in the FT with The Chart That Tells A Story, which this week was about UK dividends.

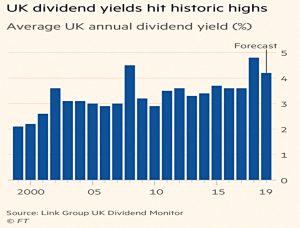

UK dividends

The combination of decent weather in August and a looming no-deal Brexit meant that there wasn’t much of interest in the financial press this week.

Siobhan Riding reported that 2018’s average payout of 4.8% was a 29-year high.

- The rate this year is forecast to be 4.2%, well above the 30-year average 0f 3.5%.

FTSE-100 companies should pay out 4.4% and FTSE-250 firms a more modest 2.9%.

Special payouts from commodities, housebuilding and banking firms have boosted the levels of recent dividends.

- And the Brexit-driven fall in sterling means that foreign earnings have increased.

The boom may not last – there have been high-profile dividends cuts this year from Centrica, Vodaphone and Marks and Spencer.

Pension transfer values

Josephine Cumbo wrote that record low yields on long-dated Gilts have pushed DB pension transfer values to record highs.

- But the rates she quoted were only 26 times the annual payout.

My last two offers were 39 times, which is far more attractive.

- An SWR target of 3.25% (the maximum failsafe rate) gives a break-even ratio of 31 times, so it doesn’t seem like a great idea to me for anyone to snap up these “record” rates.

Penny-pinching

Claer Barrett had a bit of a dig at the FIRE movement (it stands for Financial Independence, Retire Early).

Young people all over the internet are earnestly raving about how marvellous Fire is, but it’s essentially rebranding retirement saving (which, let’s face it, sounds terribly dull) as an empowering lifestyle choice.

She has half a point – the only difference between FIRE and the path I naturally followed was that I was targeting retirement around age 50 rather than below the age of 40.

- The extra ten years means a lot more saving and a lot less spending.

Claer rightly points out that rents in expensive areas can make it difficult to save more than 20% of income, but it was never that easy even 30 years ago.

- But she is also a fan of spending money for more convenience.

Cleaners, taxis and Ocado were never likely to be compatible with FIRE.

Negative rates

Merryn Somerset Webb said that negative interest rates are a risk that investors have not seen before.

- They would make it very difficult to know where the best place to put your money would be.

Stocks are pricy, especially in the US, with GMO projecting a negative 3.7% annual return from large-cap US stocks over the next seven years.

- Small-cap US is projected to return minus 1.5%, though EM markets look better.

More seriously, developed market projected bond returns are also negative.

- Institutional deposit rates are turning negative, and retail deposits could be next.

Paper money has been around for about 1,000 years. No one has, as far as we know, ever offered negative interest rates on it before. It makes it impossible to have any sense of certainty about what to do.

Merryn recommends looking into a safe so that you can hoard cash at home (we’ve covered this before), but also sticking with stocks (other than the US and tech).

Corbyn watch

Jim Pickard reported on law firm Clifford Chance’s costing of Labours plan to seize 10% of UK company shares on behalf of the workers.

- ONS data suggests that UK companies have a total book value of £5.5 trn.

The 57% of turnover attributed to larger firms would, therefore, map to £3 trn of assets.

- Which means that Labour plans to seize £300 bn via the share appropriation.

- For context, New Labour’s windfall tax on utility firms raised less than £5 bn.

Since the largest shareholders in most firms are pension funds, pensions will be hit hard.

Meanwhile, John McDonnell has told the FT that he plans to establish a “right-to-buy” for private tenants, and not at the market price:

You’d want to establish what is a reasonable price, you can establish that and then that becomes the right to buy.

You (the government) set the criteria. I don’t think it’s complicated.

Once more, you have been warned.

Quick links

I have nine for you this week:

- Collaborative Fund looked at The Laws of Investing.

- Alpha Architect examined Market Timing with News versus Social Media,

- And looked at the Low Vol Anomaly.

- Schroders had an Investing IQ test.

- Musings on Markets looked at Stakeholder Capitalism.

- CNBC reported that US stocks are now yielding more than the 30-year Treasury Bond.

- David Stevenson looked at what to do with cash as negative rates loom.

- UK Value Investor had the ultimate value investing checklist.

- And Monevator looked at how a no-deal Brexit will affect your investments.

Until next time.