Weekly Roundup, 1st June 2021

We begin today’s Weekly Roundup with a look at Biden’s plan for a global corporate tax.

Corporate taxes

Last month, US Treasury Secretary Janet Yellen called for a global minimum tax on corporations.

- The proposal will be discussed at the meeting of G7 finance ministers in London later this week.

Corporate tax planning has become much easier with the rise of intangible assets, which can “live” in low taxation jurisdictions and attract usage fees from subsidiaries in high-tax economies.

Many countries have proposed or introduced taxes on digital services from foreign firms, (DSTs), though none has been entirely successful to date.

- Yellen’s idea ought to be generally popular in the OECD club of rich countries, but unless small islands in Europe and the Caribbean fall into line, it’s not clear how much can be achieved.

Biden’s plan for the US is to raise the domestic corporate tax from 21% to 28%, and the tax on overseas profits from 10.5% to 21% (including tax havens).

- Since the large US tech firms (plus pharma and brands like Nike and Starbucks) dominate corporate tax avoidance, this would be a big step – assuming that Biden can get it through Congress.

This would help to pay for The Democrats’ “infrastructure” spending but at the cost of hurting US competitiveness.

- Hence Yellen’s idea that foreign companies should be similarly penalised by their governments.

It’s still hard to see why Ireland would be in favour of penalising Irish multinationals (( None spring to mind )) simply because the US has removed the advantage of US firms basing their European HQ in Dublin.

- The other stumbling block in the way of OEDC agreement is how to carve up profits of companies with local customers but few local workers (ie. the US tech firms again).

So the US would have to offer up some of the new tax collected in the US in order to restore a level playing field.

- Yet the US is still proposing tariffs on goods from countries with DSTs, in order to prop up the competitiveness of its tech firms.

John Authers looked at the implications for markets if these tax changes go through:

- We can expect fewer stock buybacks

- The value factor might revive (since expensive companies tend to have much lower current corporate tax rates)

- Healthcare, information technology and consumer discretionary would be the worst-hit sectors since they have large foreign profits that are lightly taxed

- Materials and energy would be least affected

There are several obvious objections to a flat global corporate tax rate:

- Companies don’t really pay tax, their customers, workers and shareholders do

- It’s just convenient for governments to make tax complicated so that voters don’t realise how much money they are losing

- There’s no moral reason why sovereign countries shouldn’t be able to compete on taxation

- A free market in taxes should mean that we end up with the optimum taxation levels (levels that people are willing to pay, but which still support a useful level of state spending)

- Cutting tax rates usually leads to the raising of more revenue, not less

Additionally, from a UK perspective, we have a post-Brexit opportunity to undercut the EU in order to attract investment from the US and Asia.

- A global flat rate could get in the way of this, though it would also provide opportunities to take back business from Ireland and the Netherlands, for example.

We might also provide rebates for trendy business areas where we would like to be leaders (green energy, AI and tech in general) etc.

Return forecasts

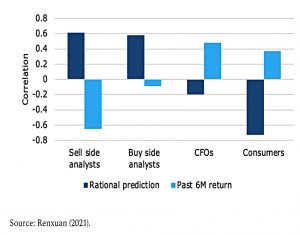

Joachim Klement looked at how investors make their return forecasts.

- A recent paper compared human forecasts to a “rational” model looking at valuation and other fundamentals.

Consumers follow past returns, reducing their return expectations after the market declined and increasing them after the market rose. Sell-side analysts do the opposite.

The sell-side analysts general expect better returns – they are chronically over-optimistic but in a rational way.

- Their forecasts correlate much more closely to those from the model.

Buy-side analysts have a lower correlation, and CFOs and consumers a negative one.

Joachim says this has implications for market movements:

If the marginal buyers and sellers in a market are the general public, markets will likely be more momentum-driven. If the marginal buyers and sellers are fund managers, markets will likely be less momentum- and more valuation-driven.

Bitcoin

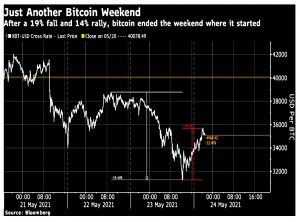

John Authers also took another look at bitcoin, which had a rough weekend before last (it has since recovered towards $40K once more).

The ongoing volatility was another reminder that BTC is not a replacement for the dollar, but John wanted to look at whether crypto’s distributed technology could cope.

- A flash crash and recovery like this suggests not, and many exchanges were down during the heaviest selling.

John’s colleague Jim Bianco notes that the centralised platforms were the ones that failed:

DeFi does not use an order book like regulated exchanges. Instead, it has over 72,000 liquidity pools. Anyone can be a liquidity provider to these pools or even start one and earn interest (more coins) for their effort.

Traders use these liquidity pools to trade cryptos. The entire protocol is run by computer code called an automatic market maker. No humans are involved in the trading on these exchanges.

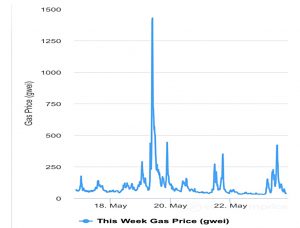

John’s counter-argument is that the cost of transacting (so-called “gas fees”) increased dramatically.

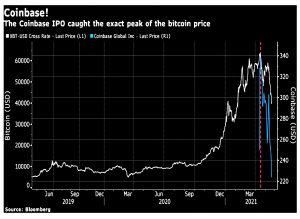

John also noted that the BTC crash should have been expected because of the Coinbase IPO:

Throughout history, initial public offerings have taken place at peaks of confidence. When the owners of a big private company think market conditions are as good as they are going to get, they will go public. And as they know what they are doing, the rest of us should take the hint.

Musk’s appearance on Saturday Night Live was a similar phenomenon – an updated version of the magazine cover contrarian indicator.

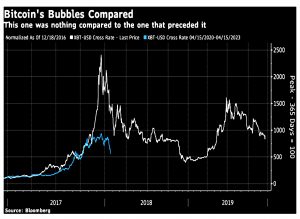

John also brought our attention to the fair value model for bitcoin created by Charlie Morris (now of Byte Tree Asset Management) back in 2013.

- His valuation is around $40K and makes the dollar/BTC price look a lot more normal.

Johns conclusion was that the bubble might not have burst forever, but we might not see the April high revisited for quite some time.

Whether it really establishes itself as a part of the global financial system will depend on how many people use it, and how tolerant central bankers are of that.

It will be worth as much as someone is prepared to pay for it. The digital currency’s fortunes are likely to remain tied to risk appetite; whatever direction bitcoin goes in, we can expect other risk assets to go the same way.

Which is not great for the “digital gold” argument.

In the FT, Brendan Greeley focused on the money aspect of bitcoin:

This is a version of Gresham’s law – bad money drives out good. (( Brendan points out that the Greeks had similar sayings ))

- If people expect one form of money to appreciate in the future, or another form of money to have its value inflated away, they will always want to use the money they don’t like in their transactions.

Good money will be hoarded for its high future value.

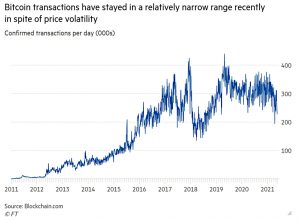

Bitcoin transactions haven’t increased significantly since the first boom in 2017, but I have to admit that I’m surprised there are as many as 300K transactions per day.

- How many of these are just people moving BTC from one location to another (eg, to a cold wallet) rather than exchanging it for physical goods and services?

Presumably, until recently, a lot of the transactions were people buying BTC with fiat, and in recent weeks, the reverse.

Brendan has another explanation:

The culture of bitcoin is fixated on the soundness of money, convinced that the best money only becomes more valuable over time. People encourage each other to “hodl” — to hang on to their bitcoins and never sell.

If you hodl, you have diamond hands. If you sell, you have paper hands. If you hodl nothing, you are encouraged to have fun staying poor.

This leads to a dilemma:

Sell, or change the code, and your asset drops in value, becoming more useful as money. Hodl, and keep the code, and your asset appreciates. Diamond hands are Gresham hands.

Quick links

I have five for you this week.

- Musings on Markets looked at inflation

- Whilst Mauldin Economics looked at deflation

- UK Value Investor worked out a buy price and a selling price for Dunelm

- Alpha Architect considered the explanatory power of factor momentum

- And wondered whether to combine or separate value and momentum.

Until next time.