Weekly Roundup, 27th February 2023

We begin today’s Weekly Roundup with inflation.

Inflation

An Economist cover is a well-known contrarian indicator, and last week the newspaper went with the idea that inflation will be harder to bring down than markets expect.

- We’ll look at the arguments, but bear in mind that this could mean inflation is about to crash.

Linked to the inflation optimism in the markets are the ideas that the Fed might cut interest rates before the end of the year and that in turn, this could help the US and other economies avoid a recession.

- This shows up as the 8% rise in the S&P 500 since the turn of the year, leaving the market on 18 times forward earnings (which are forecast to be 10% higher in 2024).

The dollar is down more than 6% since its peak in October, a sign of investors’ renewed appetite for risk.

The drivers include the recovery in global supply chains and falling demand for Covid lockdown goods.

- The oil price is also lower than before the Russian invasion of Ukraine, and there is now a chips glut rather than a chips shortage.

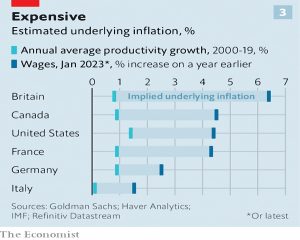

But core inflation is still rising, driven by labour costs in the services sector.

It is hard to see how underlying inflation can dissipate while labour markets stay so tight. They are keeping many economies on course for inflation that does not fall below 3-5% or so.

Bond markets are starting to predict that rates will stay high, which implies trouble for stocks (higher discount rate) and the economy (higher risk of recession).

- And even if central banks decide that higher inflation is tolerable, the transition from the old regime to the new is likely to be messy.

A second article added some detail (and provided the charts).

In 25 of the 36 OECD countries for which there is monthly data, headline inflation is falling.

But central banks don’t share the markets’ enthusiasm.

Though they are slowing the pace at which they raise interest rates, they are wary of repeating the mistakes of the 1970s, during which monetary policy was loosened in response to falling inflation only for prices to surge once more.

Central bankers are worried about wages:

They see excessive wage growth as the best indicator that inflation is likely to remain above target, because of its relevance both to firms’ costs and to household incomes.

Wage growth falling while employment and vacancies remained high would defy the models central banks have used to forecast inflation for decades, as well as simple intuition about the supply and demand for workers.

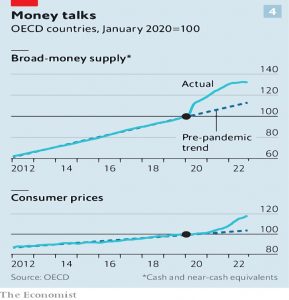

But money supply watchers think that this “immaculate disinflation” is possible.

Their argument is that the world economy has been suffering what used to be called a “monetary overhang”, in which it must work off a one-time change to the supply of money caused by a burst of stimulus. Once that overhang has dissipated, things should return to normal.

Tracking the money supply is unpopular these days, but it was of the few indicators to give early warning of inflation (as it rose by 12% across the OECD in the six months from February 2020).

- But now the money supply has been tightened and is “only” 17% above the pre-pandemic trend.

- Prices are 14% above trend, so they don’t have much more catching up to do.

Against this is the risk that the China reopening pushes energy prices back up (which would make things feel even more like the 1970s).

Buttonwood also joined in, noting that investors expect there to be no recession.

Investors often think a soft landing lies ahead as a Fed tightening cycle comes to an end. Since the 1970s, Fed policymakers have managed them precisely twice. In 1984 and 1995, America’s stockmarket began to rally just as interest rates reached their peak.

In the six other tightening cycles, there was a recession (including 2019 which was impacted by Covid).

- Even worse, in the early stages, it’s hard to tell the two outcomes apart.

Both feature interest-rate rises, followed by a pivot as the market prices in future cuts, and shares begin to rally. For the hard [landings], the worst is still ahead: employment weakens, along with housing, and investors take a battering.

Most economists still favour a hard landing, as the tight labour market and excess savings from the lockdowns delay the impact of monetary tightening.

Soft landings were typically preceded by relatively low inflation, and accompanied by looser bank-lending standards.

Which is the opposite of today.

- In addition, we have an inverted yield curve (negative 10Y/3M spread) for the ninth time in the last 50 years, and the previous eight were followed by recessions.

The next twelve months should be interesting.

Rates, inflation and earnings

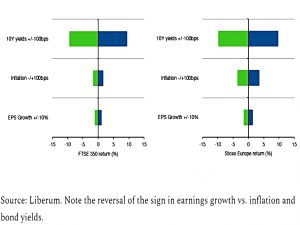

Joachim Klement came at the same issue from a slightly different angle.

- He believes (as do I) that over the short term (say 12 months) changes in bond yields (and interest rates) and inflation have more impact on stock market returns than do changes in equity earnings.

Most people in the industry work the other way around, trying to predict future earnings and work out a valuation from them.

Joachim notes that 2023 will be a good year for testing the impact of both:

- we should get an end to interest rate hikes, at least for the Fed and probably for the BoE and ECB as well

- inflation has peaked and is coming down slowly, so inflation expectations for 2023 will decline

- real rates should decline, particularly if there is a recession, so long-term bond yields should decline

Declining bond yields means lower discount rates for future stock earnings (cash flows) but a recession would mean lower earnings and lower earnings forecasts.

- So stock valuations could go up (because of lower rates) or down (because of lower earnings).

Joachim thinks that earnings-focused investors are making a mistake:

The earnings decline in a recession is large, but it only impacts the projected cash flows over the coming 12 to 24 months. The change in bond yields may be small, but this change impacts every cash flow from today to eternity.

Joachim looked at the historical impacts on the FTSE 350 and the Stoxx Europe indices.

A 100bps change in bond yields has about 10 times the impact on share prices than a 10% change in earnings for the coming year.

Joachim expects a 100bps drop in bond yields during 2023, which is good news for stocks.

Earnings growth must suffer a really large drop before [it] can compensate for the effect of declining bond yields. Even if we are in recession and earnings drop a lot in 2023, share prices may go up rather than down.

Which would be unusual.

Premium bonds

The Premium Bond prize rate has gone up again – for the fifth time in ten months, and the third month in a row.

The latest increase is from 3.15% to 3.3%, starting with the March draw.

- The last time the rate was higher than this was in May 2008.

This is an extra £15M per month in prizes, to a new total of £329M.

- There are still around five million prizes awarded each month, with the increase being used to increase the number of larger prizes (though not the jackpots) and reduce the number of the smallest prizes (worth £25).

For example, there will be 62 £100K prizes (up from 59) and 123 £50K prizes (up from 117).

- The odds of winning remain at 1 in 24K.

The new increase keeps Premium Bonds above the highest rate available on an instant access savings account.

- In addition, winnings from PBs are tax-free, which is particularly useful to higher-rate taxpayers.

NS&I CEO Ian Ackerley, said:

Premium Bonds are one of the nation’s most loved ways to save, giving people the monthly anticipation of a potential win while knowing their money is 100% safe. We are committed to ensuring our products remain attractive and our customers can continue to save with confidence.

EIS vs VCT

In FT Adviser, Sally Hickey reported that financial advisers use EIS more than VCTs.

The data comes from a Deepbridge Capital survey of 168 IFAs in December 2022.

- 11% use only EIS

- 26% use mostly EIS

- 31% use both

- just 2% use only VCTs

As a user of VCTs and hardly any EIS, I must admit this result surprises me.

- I would be interested to know the age profile of the IFAs’ customers and also whether there are better IFA incentives to push their clients towards EIS.

I prefer VCTs for two reasons – tax-free dividends and easier exits (after five years).

- In the decumulation phase of investing, VCTs seem more attractive (something that is backed up by the age profile of the attendees at the VCT AGMs I sometimes go to).

I would be more interested in EIS if I had more money to invest, and longer to wait for its return.

- This implies a younger customer – one (unlikely) option is that IFA clients are younger than I think.

It could also be that EIS is a much bigger market than VCT.

- I know that VCT has been doing very well in recent years, but perhaps EIS is doing even better.

The other possibility is that most IFA clients are interested in IHT planning – and EIS shares qualify for Business Property Relief (as do most AIM stocks).

IHT

This brings us to the news that Inheritance Tax receipts in the UK increased by £0.9 bn in April 22 to January 23 (compared with the same period the previous year).

- The new total was £5.9 bn, on track to beat the annual record of £6.1 bn.

Most of the increase in recent years comes from property price increases in London and the South East, which push many estates over the maximum allowance of £1M (for a couple passing on property to their children).

- Meanwhile, the basic individual limit remains frozen at £325K until April 2028.

IHT remains the most unpopular tax and at the same time one of the most avoidable.

- Simple shelters include pensions, most AIM stocks, EIS and giving money away seven years before you die.

Quick Links

I have six for you this week, the first two from The Economist:

- The Economist said that It’s time for Alphabet to spin off YouTube

- And reported that Facebook sells subscriptions as the ad business stumbles

- Alpha Architect looked Inside the Minds of Expected Stock Returns

- Ed Conway said It’s the Energy, Stupid

- UK Dividend Stocks provided their UK Housing Market Valuation and Forecast for 2023

- And Tax Policy wrote about The tax scandal within the Post Office scandal, and how to fix it

Until next time.