Weekly Roundup, 23rd December 2014

We start today’s weekly roundup with more pensions reviews.

Contents

IPB pensions review

Josephine Cumbo in the FT reported that pensions minister Steve Webb wanted “big, bold answers” from the industry. The minister was responding to the findings of the Independent Project Board, which reported that fees on many legacy pensions were above 1% pa, and for those with pots below £10K, often as high as 3% pa.

£26bn of assets within pre-2001 schemes and £12bn of assets in post-2001 schemes were subject to the high charges. Webb said that he wanted action before the new pension reforms come into force in April 2015. One option is the scrapping of exit fees – more than £3bn of savings are subject to exit fees of more than 10%. Removing monthly fees is another possibility.

FCA review of RDR

There was widespread coverage of the FCA’s review of RDR (the retail distribution review) which found that a third of financial advisors are still not disclosing the ongoing charges for their services in cash terms, preferring instead to hide behind a percentage figure.

Where advisors charged by the hour, the corresponding tactic was to not tell customers how long each service was likely to take. In generic documentation, advisors presented a wide range of costs which made it difficult for customers to understand what they would pay, or to compare one advisor against another.

Firemen’s pensions

Jonathan Eley examined the parliamentary vote on the proposed replacement of a final salary pension for firemen with one based on career average earnings. The vote was narrowly won and the new scheme will begin in 2015.

Predictably the union objects to a scheme which is far more generous than the typical private sector pension because it replaces a ludicrously generous one – providing two-thirds salary at age 55 for 30 years service (the equivalent of 50% annual contributions in a DC scheme).

There are still 5.7m public sector workers, and most of their pension schemes will require increasing levels of public support from the taxes of those with less generous and secure arrangements.

Generous benefits

Continuing with the theme of state generosity, Merryn wrote in her MoneyWeek blog about the munificence of the UK benefits system. An unemployed couple with two children in the south east receive £24.3K tax free (equivalent to a taxable income of £32K, significantly more than the average UK wage).

A single mother with two kids gets just under £24K (equal to just less than £32K). A single man gets “only” £12.3K. As Merryn says, good will to all men indeed.

Low-cost online advice

Merryn also pointed me towards SaidSo, a new online-only simplified advice service for the mass market. The site charges £299 for an initial report, plus £159 to implement the recommendations and £129 for a subsequent review.

Even for a typical private investor with a £50K pot, these charges are not terrible. Assuming you go along with the SaidSo recommendation of yearly reviews, the total cost over a 40-year investment career would be £5.5K, or 0.3% per year.

Drop down to 5-yearly reviews and the costs reduce to £1.5K or 0.1% pa. For one of the 7C investors, with a typical average pot of £500K, the charges are 0.03% and 0.01% respectively. So everything hangs on the service itself. We must wait and see.

Santa rally

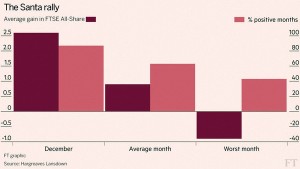

Returning to the FT, Jonathan’s chart of the week column dealt with the Santa Rally.

The graph covers the FTSE All-Share index since 1984 and shows the outperformance of December versus the average month and the worst month (September). December has an almost 90% chance of being positive, and typically delivers 2.6% versus the average monthly gain of less than 1%.

There’s no clear explanation other than general good cheer and low trading volumes. April is another good month, driven by end-of-tax-year rebalancing of portfolios. There has been a decent rally this December too, but it has come late, and merely retraces most of the ground lost in the oil / rouble / Grexit collapse of the first half of the month.

That’s it for this week, so I’ll close by wishing you all a Merry Christmas. I have plans to post again before the New Year, but we’ll see how they work out.

Until next time.