Weekly Roundup, 28th March 2022

We begin today’s Weekly Roundup with windfall taxes.

Windfall taxes

The Economist had a couple of articles on windfall taxes.

Whenever oil and gas are expensive, politicians’ eyes turn greedily to the profits of energy firms.

Bulgaria, Italy, Romania and Spain have already introduced new taxes, and the EU and the Democrats are making noises.

- Here in the UK, Rishi Sunak came under pressure to tax BP and Shell in the recent Spring Statement.

The typical argument against windfall taxes—that even when they are retroactive, they risk deterring future investment—has become less powerful now that most of the world is trying to phase out the burning of fossil fuels.

But the newspaper still thinks they are a bad idea.

- Elizabeth Warren wants to take half of the price of a barrel of oil above the 2015-19 average price.

Two of those years had a negative margin (losses) for the industry as a whole, and 2020 was negative, too.

If companies must endure the bad times but find chunks of their profits are seized when prices rise, their businesses lose viability.

And we can’t afford to lose fossil fuel firms right now.

Renewable energy cannot immediately replace gas for some tasks, such as heating homes with gas boilers. Even if the infrastructure to run entire economies on electricity were in place, battery storage remains unable to plug gaps when the wind does not blow and the sun does not shine.

We need more nuclear, but that will take years to build.

Hiving off the rewards that are on offer for supplying energy during today’s shortage will only make the next supply crunch—even a predictable one—all the worse.

Cash

In his regular FT column, John Redwood wrote that cash is now king in these uncertain times.

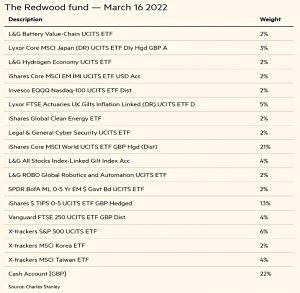

- He had mentioned the high cash level in his fund last time out – it’s now at 22%.

John also did well to get out of Chinese shares before they fell, though it looks as though recovery may have started now.

John had been worried about inflation and rising interest rates, but since then we have added war to the mix.

There have been wide-ranging and extreme market reactions, with energy, grains and some other commodities sent much higher as investors evaluate the impact of the sanctions imposed on Russia and supply interruptions. These events will bring both higher inflation and slower growth in advanced economies.

Inflation and rising energy and food costs, in particular, mean less discretionary spending by consumers.

The war is not good for stocks, and the retreat from globalisation towards local security in energy, food, commodities and tech will be difficult to negotiate.

- Spending – particularly on defence and green energy, which now includes nuclear – will increase and so will taxes.

There are also likely to be more price controls, state involvement in business and regulations to try to tame unruly markets.

John is sticking with cash and indexed bonds until he sees how the central banks respond to low growth and high inflation.

Nickel

The Economist had a bit more on the nickel-trading fiasco that we looked at last week.

Three big questions remain. How important is Tsingshan’s role in the debacle? Did its troubles provoke interference from China? And has the LME bungled its response?

One issue for Tsingshan is that the nickel it produces is not the type traded on the LME.

- This mismatch between its shorts and longs was the driver of its margin calls

On the second question, the LMW denies Chinese pressure.

On the third:

[The LME said] its decision to cancel that day’s trades was because the big price moves had created a systemic risk to the market, raising concerns of multiple defaults by member-brokers struggling to meet margin calls.

The issue is that it favoured the shorts (hedging by physical producers and their banks) over the longs sitting on large paper profits.

Yao Hua Ooi of hedge fund AQR said:

The decision to erase the trades will undermine long-term confidence in the LM. If you want the AQRs of this world [in the market], you cannot intervene when they make money and it hurts your brokers.

Nickel trading reopened on 16th March with daily price move limits.

New FAANGs

Merryn Somerset Webb’s FT column was mostly about the effects of inflation on people’s retirement prospects.

- Even DB pensions usually come with a cap on the annual uplift, and inflation this year looks set to be higher than most caps.

DC pensions will also be down from their peaks, reflecting the crash in large US tech stocks.

Merryn also mentioned a new report from Merrill Lynch which suggested that we redefine the FAANGs.

- The old list was Facebook, Apple, Amazon, Netflix and Google.

The new suggestions are fuels, aerospace, agriculture, nuclear and renewables and gold/metals and minerals.

All these sectors have done well this year so far, for obvious reasons. But there is every reason to think they will continue to do so in the medium term.

Floww

The LSE is planning a new exchange for private companies.

The new bourse will be a partnership with Floww, a database for private firms and venture-capital funds in which the LSE’s parent company has bought a minority stake. Floww was designed to connect startups to potential investors by enabling them to share commercial data in a standard, easily verifiable form.

The LSE will add a platform where capital can be raised by selling equity stakes – a kind of crowdfunding for VC firms only (ie. without the crowd).

- There will also be a secondary marketplace to allow investors to trade shares.

This should make it easier for private firms to transition to public markets when they are ready.

The hope is that the private firms joining the new exchange will be more likely to list in London when they go public. A boost is sorely needed. In 2005 the City hosted 20% of the world’s initial public offerings; by 2021 that had fallen to 4%.

In theory, it should be d its good for investors too:

Onerous reporting obligations for listed firms have led to companies staying

private for longer, growing all the while. That delays the moment when most investors can buy in, denying them a larger share of the wealth successful companies generate.

The new exchange will target institutional investors at first but aims to allow retail investors eventually.

- I’m not sure there will be much appetite, however, since private investors can invest with tax relief by using EIS and VCTs.

Crypto

The FCA has ordered all of the crypto ATMs in the UK to shut down.

- These machines look like regular ATMs but are more like lottery terminals – you pay with your bank card and get a slip with your entitlement to crypto in return.

Although there are 81 such machines in the UK, there are no firms with a licence to operate such a machine.

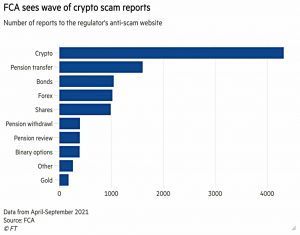

According to Joshua Oliver in the FT, the FCA opened 300 probes into unlicensed crypto firms during the six months to September 2021.

- The FCA also said that reports of crypto scams were up by 50%.

Consumers reported 4,300 potential crypto scams to the FCA’s ScamSmart website over the six-month period last year, far more than the 1,600 reports for the next most common category, related to pension transfers.

Joshua also noted a survey by AJ Bell which said that 30% of crypto investors have more than 10% of their portfolio in digital assets.

- A third of crypto investors also say that they aren’t prepared to lose any of their money.

Half of these people don’t have an ISA and 40% don’t have a pension. Laith Khalaf, head of investment analysis said:

[This] suggests that a high proportion of crypto investors are jumping in at the deep end of the risk spectrum, and bypassing the basic building blocks of a financial plan.

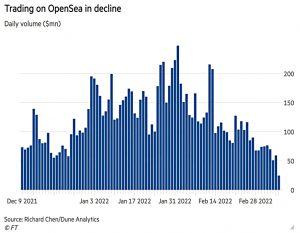

Also in the FT, Tim Bradshaw (along with Miles Kruppa and Cristina Criddle) reported that the NFT craze may have passed its peak.

[NFTs] burst into mainstream culture last year, as several animal collections including Bored Ape Yacht Clubspiked in price, aided by celebrity endorsements and social media hype. By the end of 2021, nearly $41bn had been spent on NFTs.

That’s almost as much as the regular art market.

- But the average selling price is down by 48% since November, at $2.5K.

Daily trading volumes on OpenSea are down 80% to $50M, after peaking at $248M in February.

- And the number of weekly active accounts is down from 380K in November to 194K.

The average price of a Bored Ape NFT, a collection that counts celebrities such as Gwyneth Paltrow and Snoop Dogg as owners, has fallen 44 per cent since the war in Ukraine began as investors pull back from trading colourful cartoons.

The “blue-chip” NFT index from Bitwise – which is mostly Bored Apes and CryptoPunks – is down 25% in the last month and 17% for the year.

Quick Links

I have just three for you this week, the first two from The Economist:

- The newspaper looked at the parallels between the nickel-trading fiasco and the LIBOR scandal

- And said that energy insecurity is here to stay.

- Alpha Architect reported that investment flows can affect prices.

Until next time.