Weekly Roundup, 4th April 2022

We begin today’s Weekly Roundup with stocks and bonds.

Contents

Stocks and bonds

John Authers looked at the relative performance of stocks and bonds.

Stocks have beaten bonds in the U.S. in a phenomenal way. In this century, there have been only four previous two-week periods when stocks beat bonds by this much.

All of these came at stock market bottoms (good times to buy stocks).

- And they were all rebounds from proper market falls, much more serious than the one we’ve seen in 2022.

John looks to inflation and its impact on long-duration assets (stocks and bonds) for an explanation.

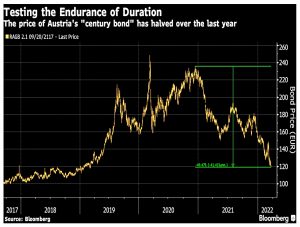

- Here’s the effect on the Austrian 100-year bond:

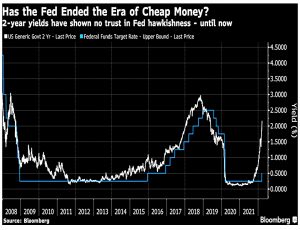

He also notes that the market now believes in seven more rate hikes from the Fed, as shown by the 2-year yield.

Two-year yields did get higher than this in 2018, but they were pushed there grudgingly after a significant series of rate hikes.

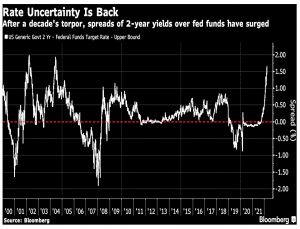

The two-year spread over the prevailing Fed Funds rate is even more convincing:

Rising rates will reduce the value of future cash flows, and hence of companies.

- They will also make borrowing money to buy a house more expensive and make it harder for firms to refinance their debt.

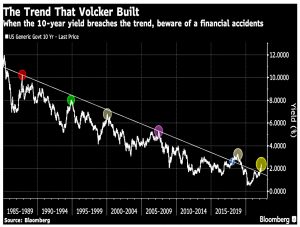

Moving to ten-year yields, John notes that every time we hit the downtrend line from the 1980s, we have a financial accident.

The circles indicate the Black Monday crash of 1987, the Orange County and Tequila crises of 1994; the bursting of the dot.com bubble in early 2000; and the onset of the credit crisis in 2007.

Then in early 2018, when the Fed’s tightening actually brought yields above their long-term trend, we witnessed the so-called “Volmageddon” selloff and the “Christmas Eve Massacre” selloff. All that financial turbulence was enough to force the Fed to pivot and abandon its tightening.

This brings us back to the beginning.

- The first chart says that it’s a good time to buy stocks, but the last says that it’s a good time to sell stocks.

Stocks vs bonds is positive, but bonds alone are negative. John thinks that the key might be inflation:

The point of Volcker was that he eliminated inflation from the equation. The Fed relented and came to the rescue in all the crises and mini-crises of the last four decades because it could. Inflation wasn’t particularly high and nothing too much was lost by cutting rates. That isn’t true now.

Covid led to even more money printing than QE, and then to supply chain issues.

- And the Russian invasion of Ukraine has made things even worse.

John’s head still says that stocks must fall as rates rise, but he wrote a similar article 15 years ago.

- We had the subprime mortgage crisis at the time, and the credit crunch soon after.

But bond yields didn’t rise any further, as the crises in all the other markets pushed the money back into bonds.

The market moves of the last few weeks show that tectonic plates are shifting. How exactly they shift from here, and how the economy and the markets will interact to resolve the situation, is something we’ll find out in the weeks ahead.

Some huge risks and opportunities beckon; we should all keep an open mind and be prepared to react quickly, both to avoid risks and take opportunities.

Cut your losses

Joachim Klement looked at the disposition effect – the tendency to sell winners and hang on to losers.

- This is the opposite of what you should actually do and results from the reluctance of investors to admit that they have made a mistake.

Instead, people hand on in the hope of selling at break-even or a small profit.

- Selling winners early is popular because it lets you brag about how great an investor you are.

One of the major problems with the disposition effect is that stocks move in trends, and selling your winners while hanging on to your losers leads to underperformance.

There are also tax issues if you are using a taxable brokerage account (winners attract CGT and there are no crystallised losses to offset the gains).

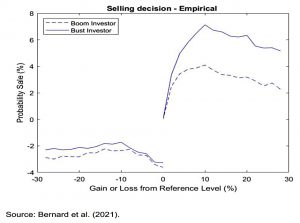

Joachim’s article looked at a new study that shows that the disposition effect becomes even stronger in a bear market.

- The market environment has little effect on the likelihood of selling at a loss, but it makes investors much more likely to sell winners.

Investors are petrified in a bear market and try not to sell their losers. But when they see an exit sign in the form of an investment that has made a gain while the rest of the portfolio is down, they try to lock that gain in as fast as they can.

This is the wrong thing to do, since, in bear markets, losers tend to lose even more than usual.

War and sanctions

In a second article for the CFA Institute, Joachim looked at the impact of the Russia-Ukraine war.

There are reports that many Ukrainian farmers are abandoning their fields at the beginning of the sowing season.

Russia and Ukraine are big exporters of grain, though most wheat is eaten where it is grown.

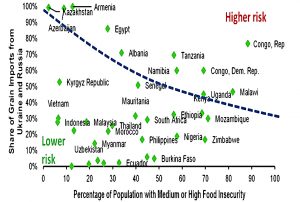

In developed countries, high inflation and sector shortages lead to reduced consumer discretionary spending, so the risks are greatest in EM nations:

The warring nations are responsible for at least 80% of the grain supply in Benin and Congo in Africa; Egypt, Qatar, and Lebanon in the Middle East; and Kazakhstan and Azerbaijan in Central Asia. All these states will have to find new sources of grain and pay much higher prices for them.

This will increase inflation in these countries.

- Joachim draws a parallel with the condition prior to the Arab Spring uprisings of 2011.

And it could get worse:

Spiking energy prices will increase shipping and fertilizer costs. With Russia, a major fertilizer exporter, facing severe sanctions, there will be even more upward pressure on fertilizer prices.

The risk is hunger, and therefore riots.

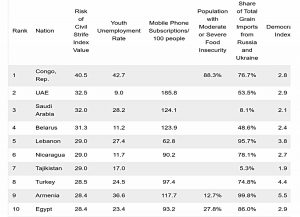

Joachim constructed a Civil Strife Risk Index from five key stability metrics:

- The percentage of their total grain imports from Russia and Ukraine

- The share of their populations with moderate or high food insecurity

- Their youth unemployment rate

- The number of mobile phone subscriptions per 100 people

- Their Democracy Index rating

The table shows the countries at most risk:

The oil exporters — Saudi Arabia and the UAE — and Turkey, with its close trade links to the United Kingdom and the European Union, are the most troubling from an economics and investing perspective.

Any trouble here would be an early warning sign of supply chain disruption heading for Europe and the UK.

Pensions tax

In FT Adviser, Maria Espadinha reported that the number of people breaching annual and lifetime pension allowance limits has hit a new record.

- Figures for 2019/20 show a 24% rise in the number of annual breaches (42,350 people) and a 16% rise by value (to £950M).

Breaches of the LTA rose by 19% to 8,510 and were up 21% by value (to £342M).

The LTA is frozen until 2025/26 and the AA has been at £40K since 2014/15.

- So we can expect these numbers to get worse in the coming years.

Green bonds

In the FT, Joshua Oliver reported that sales of the UK’s green bonds have been underwhelming.

- This is far from shocking since the 3-year bond pays 1.3%, which is less than the new instant saver account from JP Morgan Chase (at 1.5% pa).

It was launched in 2021 at an even more paltry rate of 0.65% pa.

- Anyone who invested between October and February is still stuck on that rate.

The government hopes to raise £300M from the green bond, which is a small part of the £4 bn it wants to raise from retail savings in the current tax year.

- During the same period, the Debt Management Office (DMO) expect to raise £10 bn in green bonds from professional investors.

Chase Saver

JP Morgan Chase has launched a market-leading instant access savings account that is worthy of investigation.

- It pays 1.5% pa, more than double the 0.7% pa of its main rival Marcus (from Goldman Sachs) and you can put up to £250K in there.

Of course, UK government insurance only runs to £85K (though I doubt that JPM is in much danger of failing) and at 1.5%, you would hit your £1K savings allowance on a balance of £67K.

- The only downside I can find is that it only operates through a phone app (Marcus also has a browser interface).

There will be some people who don’t like that, and it’s not ideal for a POA situation where the person with POA might not have access to the vulnerable individual’s phone.

Other, than that, it looks good.

- I already had the Chase app for the 1% cash back debit card, so opening the savings account was just a matter of pressing a button in the app.

Quick Links

I have five for you this week, the first three from The Economist:

- The Economist said that legislation and litigation threaten Apple and Google’s profits

- And that weaning Europe off Russian energy will mean making changes

- And that America’s gas frackers are limbering up to save Europe.

- Musings on Markets characterised ESG’s Russia Test as Trial by Fire or Crash and Burn

- And Alpha Architect wondered whether stock market bubbles are identifiable.

Until next time.

RE Chase Saver @ 1.5%

Marcus is now 1.00% (0.90% + 0.10% bonus for 12 months)

Savings accounts slowly beginning to move higher.

Yes, I wrote the post before they upped their rates (which happened after I moved my cash to Chase).

1.5% pa is not much use with CPI at 5.5%, but it’s better than 0.7% pa.