Weekly Roundup, 21st March 2022

We begin today’s Weekly Roundup with a look at the nickel market.

Nickel

Quite a lot of people wrote about nickel last week. We’ll start with James Mackintosh, who now writes in the Wall Street Journal.

- He looked at the moral hazard lessons of what he called the Nickel Market Disaster.

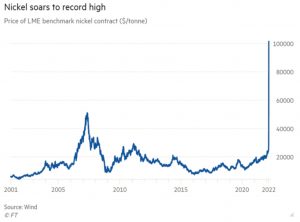

It all started when a huge spike in prices meant that a large Chinese producer (Tsingshan Holding, run by Xiang “Big Shot” Guangda) couldn’t meet its margin calls.

Instead of letting the market cleanse itself of this indebted trader, the exchange decided to wade in and save the firm from the consequences of its bets by canceling the trades.

James sees this as the culmination of a long-term trend that is undermining free markets and creating the wrong incentives:

A growing reluctance by the authorities to let financial groups go bust, even when they aren’t too big to fail.

If Tsingshan had gone down, so would have several of the smaller LME brokers that has been servicing its trades. But instead:

LME decided to cancel all that day’s trading, more than 9,000 trades worth about $4 billion.

At the time of writing this, nickel trading has still not reopened, though Wednesday 16th March has been pencilled in for a restart.

As James points out, this was not a fat-finger error or a rogue algorithm, just someone trading with too much leverage.

What is almost unprecedented here is that the exchange authorities decided to save them [Tsingshan and the borkers] with money taken from other traders, who otherwise would be sitting on fat profits.

Apparently, this happened in 1869, in the US gold market.

There are two consequences:

- If markets cannot punish the over-leveraged, we can expect more regulation to limit the leverage available

- If brokers know the exchange will save them, they need not police the level of their clients’ leverage.

It’s also likely that the LME – owned by Hong Kong-based group HKEX – will suffer, as traders will not want to run the risk of winning trades being cancelled.

Tsingshan is the world’s largest nickel producer, and its operations could be described as hedging.

- It was unlikely to have a problem at contract maturity, but it lacked the liquidity to cover the margin needed for short-term market moves.

But then again, that’s how everyone goes bust – they run out of cash.

James draws a parallel with LTCM and other hedge fund and broker blow-ups.

Next up is Helen Thomas in the FT, who said that the incident shows that the metals market needs reform.

- She notes that moving contracts onto exchanges backed by a central counterparty was one of the lessons supposedly learned from the collapse of Lehman Brothers in 2008.

Exchange trading brought transparency about exposures for different players. Clearing gave certainty and protection in the event of a default. What could possibly go wrong?

The LME has previously tried to introduce more visibility of exposures and position limits, but this was rejected by its members.

- It now plans to bring in circuit breakers as part of the re-opening.

This is a 145-year-old market that has seemed hell-bent against reform or modernisation, defeating a proposal to close its open outcry floor and requiring a code of conduct in 2019 to make clear that daytime drinking and official parties at the Playboy Club just weren’t really on.

Helen also raises the question of why the FCA and the BoE hadn’t insisted on more safeguards already.

Also in the FT, Phillip Stafford and Robin Wigglesworth quoted Alex Gerko, co-chief executive of electronic market maker XTX Markets, who called the LME the “Soviet Metal Exchange“.

AQR, run by Cliff Asness, is looking at legal options. He described the LME as “slime balls” in a series of angry Twitter posts.

You don’t get your legitimate profits because, gee, someone else, a broker who didn’t manage things so well, might suffer.

I’m accusing you [the LME] of reversing trades to save your favoured cronies and robbing your non-crony customers. Everyone who trades should know what you did. You got lawyers, I’m ready.

The LME faces a conflict of interests between members who trade to hedge and those who speculate. Matt Chamberlain, LME’s chief executive, said:

One of our key responsibilities is to serve the physical traders. If we allowed the trades to stand, we would have to say that the price of nickel is $80,000-$90,000 and that would not seem rational to the physical market. And we could have placed significant stress on a number of our core members.

Part of the current problem appears to be that Tsingshan had 80% of its position off-exchange, in direct contracts with banks.

- Chamberlain has previously pushed for such positions to be disclosed.

LME’s main competition is the CME futures exchange in Chicago.

- CME trades aluminium, copper, and zinc, but not nickel.

John Authers also covered the issue.

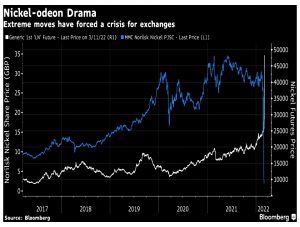

Sanctions have led to a halt in trading of shares in Norilsk Nickel, Russia’s biggest producer, on the London markets after a dramatic fall.

Russia is a huge producer of nickel; if the West is seriously going to bar trading in its biggest nickel-producing company and choke off imports, naturally that will mean the shares become uninvestable, while the cost of the metal will go up, a lot.

He quotes his Bloomberg Opinion colleague Javier Blas:

The exchange should have shut down at the end of Monday — and the U.K. regulator, the Financial Conduct Authority, should have insisted on it.

Help to Buy

In the FT, Neal Hudson looked at the legacy of the Help to Buy scheme.

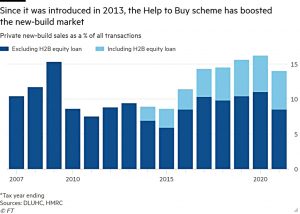

- The scheme was intended to get more young homebuyers onto the property ladder, but it has ended up increasing prices (( As anything that makes financing a purchase easier might be expected to do )) and boosting the profits of the housebuilders.

Neal also makes the point that we now have a lot more ugly, low-quality houses around the country, but I don’t think that’s down to HTB.

- We want and need more houses, and nobody is prepared to pay for the build quality of many decades ago.

HTB is now into version 2 (version 1 ended in 2021), which has one more year to run.

- The final cost of the scheme to the taxpayer is expected to be £29 bn (though this may be recovered as loans are repaid).

Version 1 launched in 2013 and offered a 20% loan on a new-build.

The scheme originally corrected a market failure: it bridged the affordability gap between buyers, the cost of new-build homes, and mortgage lenders who, since the financial crisis, had been reluctant to lend at loan-tovalue ratios higher than 75 per cent on new-build properties.

Neal claims that higher value loans were available on second-hand homes, but that doesn’t make a lot of sense to me.

- If more loans were available, more old homes should be purchased, driving up the price of old houses until the new builds were attractive again, even with the lower LTV.

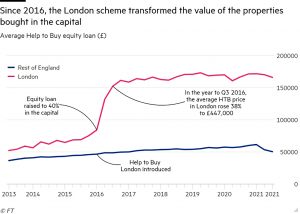

In 2016, a London variation increased the loan to 40% of the property value, pushing up prices.

The average equity loan taken out in the capital jumped from £69,000 in Q3

2015 to £152,000 in Q3 2016. As a result, the median house price paid under Help to Buy in London rose from £323,000 in Q3 2015 to £447,000 in Q3 2016.

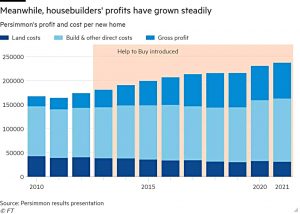

HTB also led to a doubling of profits at Persimmon:

[In] 2013, for every new home the company built, Persimmon spent £144,400 on land and build costs and made a gross profit of £36,500. By 2019, the land and build cost was unchanged, but the gross profit had nearly doubled to £71,300.

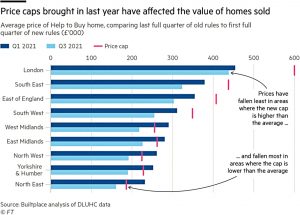

In 2021, regional price caps were introduced.

The caps are most binding in the Midlands and the north, where they are below the average Help to Buy price recorded at the end of the old scheme. By Q3 2021, the first quarter completely under the new rules, average prices were already falling sharply.

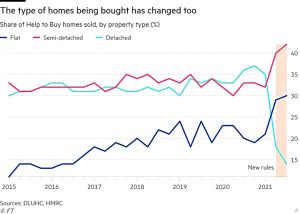

The mix of properties has also changed:

In Q1 2021, more than a third of homes sold through Help to Buy were detached homes, by Q3 that had fallen to just 14 per cent.

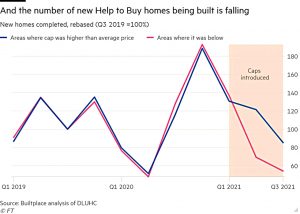

Supply is also being affected:

In Q3 2021, the number of new homes being built in areas where the cap was higher than the average price was 15 per cent down on the same quarter in 2019; in areas where the cap was lower, it dropped 46 per cent.

The big question is what will happen when the scheme ends. (( Assuming it does end – the government will still want to prop up the housing market, but the London and South East bias of HTB doesn’t sit well with the government’s “levelling up” agenda for the North ))

- In all likelihood, the transactions that are only profitable for housebuilders because of HTB won’t happen, and those homes won’t be built.

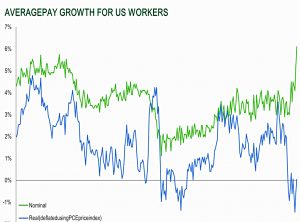

US wages

Jamie Dannhauser of Ruffer looked at wage-price pressures from the US, amidst claims from officials that inflation is transitory.

Policymakers cite two reasons for this: firstly, because the energy shock will hurt demand (it will lower inflation) more than it lifts firms’ costs. And secondly, because supply chain bottlenecks, driven exclusively by the pandemic, will be resolved swiftly as health risks subside.

The problem is interest rates.

To keep a lid on inflation, economies need materially higher real interest rates; but what they need, financial markets cannot tolerate. Central bankers disagree. In their eyes, inflation can be contained while keeping real interest rates (inflation-adjusted interest rates) at or below zero.

The idea is that disinflationary pressures (globalisation, digital tech, demographics) will bridge the gap.

In the US, workers face a cost-of-living squeeze at a time when labour markets are running red hot.

- If they resist, we face a wage-price spiral.

So we had better get used to the idea of more inflation for longer.

Quick Links

I have just three for you this week:

- Alpha Architect asked whether financial crises are predictable

- And took a deep dive into the low beta premium.

- And The Economist said that sanctions dodgers hoping to use crypto are likely to be disappointed.

Until next time.