Weekly Roundup, 28th February 2022

We begin today’s Weekly Roundup with green bonds.

Green bonds

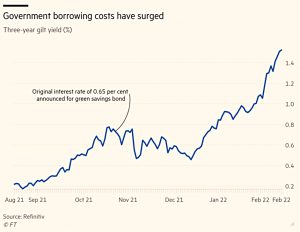

The government has announced a second tranche of “green bonds”, issued by NS&I.

- The new issue of Green Savings Bonds – capped at £100K per person – pays 1.3% pa for a fixed three-year period.

That’s double the rate of the first issue from last autumn (launched in advance of the COP26 climate conference).

- Of course, we’ve had two BoE interest rate rises (totalling 0.4%) since then, which accounts for most of the increase.

When the original green bond was announced, the interest rate was around 0.05% below the yield on a gilt of equivalent maturity.

- The new rate is 0.2% lower.

NS&I also boosted rates on another couple of its savings products a couple of weeks ago, suggesting that the government is finding it harder to bring in cash.

- No figures have yet been announced on the popularity of the first tranche, but data is pending.

More rate hikes are on the way, and with a serious possibility of inflation averaging 5% pa or more over the next three years, the new issue doesn’t look very attractive to me.

- I’d rather get 0.6% pa and have instant access in case of investment opportunities, plus a bit more in premium bonds (effectively at 1% pa).

No doubt some savers will want to put their money where their sustainable values are, and for them, this is welcome news.

- Of course, in the long run, they would probably be better off investing in one or more of the hundreds of “sustainable” investment trusts and ETFs.

Labour vs Capital

The Economist looked at whether firms or workers are winning in the post-lockdown economy.

- BoE governor Andrew Bailey hit the headlines last month when he suggested that workers should moderate their wage demands to avoid a wage-price spiral.

True enough, but he didn’t tell companies not to raise their prices.

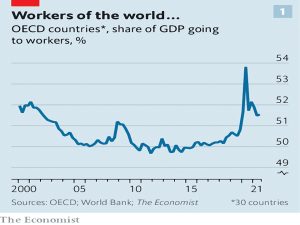

There can only be one winner. Economic output must flow either to owners of capital, in the form of profits, dividends and rents, or to labour, as wages, salaries and perks.

Labour’s share soared in 2020 as firms (supported by government stimulus) paid wages even though GDP had collapsed.

- As economies recovered in 2021 (we only have data to September) capital fought back, though labour is still ahead of pre-pandemic levels.

Looking forward, The Economist suggests that countries will fall into one of three camps.

In Britain, labour is winning.

- Wage growth is around 5% pa, and companies don’t have a lot of pricing power – profit margins are half the level of 2019.

In other rich countries outside the US, it’s a draw.

- Pay growth is below pre-pandemic levels and in some countries, negative – but margins are still below pre-pandemic levels.

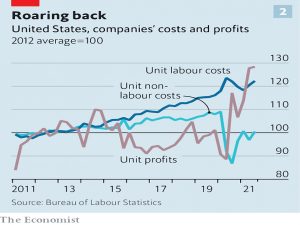

In the US, companies are winning.

- Wage growth is around 5% pa, as in Britain, but US firms are doing a much better job of protecting their margins.

Left-over stimulus payments mean that households can pay higher prices.

Wages are rising, but markups are responsible for more than 70% of inflation since late 2019.

This greater pricing power could explain the higher PEs of US firms.

Build to rent

In the FT, George Hammond and Ian Smith reported on L&G’s plans to put £2.5 bn of pension cash into homes for rent.

- They plan to build 7,000 new homes on derelict city centre sites in need of regeneration.

The build-to-rent sector — usually purpose-built blocks of flats owned by long-term investors — had a record influx of investment last year from banks, property funds and institutions looking to profit from the country’s housing shortage.

Developments initially targeted London but have now spread to regional cities, where yields are higher.

- L&G already has £2.5 bn invested in 20 of these schemes, but this is the first time it has used corporate pension schemes to fund them.

Dan Batterton, L&G’s head of build to rent said:

Our average resident is 30-years-old, but the average age of the [pension scheme beneficiary] is obviously significantly higher than that. It is taking wealth that is locked up within the pension system and releasing that to provide wider economic benefits — creating jobs, creating homes.

Other investors in the sector include Lloyds, Macquarie and Goldman Sachs.

- The bet is that the housing shortage and rising population will support demand and keep rents high.

Lots of would-be buyers are also forced into renting by high property prices.

Size of the state

The Economist looked at the size of the UK state.

- The newspaper expects that the will soon be larger (cost more) but will provide less.

Governments often use the principle of shrinkflation (a smaller pack size for the same money, on the basis that consumers are more likely to notice a price rise) to disguise inflation in their services.

- Now we are starting to see price hikes (higher taxes) but may be expected to pay more for less.

Things that few will have noticed include:

- less frequent bin collections

- more restrictive legal aid

- fewer crimes solved

Now taxes have to rise just to stop services from getting worse.

The (left-leaning) newspaper is exercised by the fact that the services will go to the elderly, who will not pay for them.

- But that’s the principle of a redistributive welfare state.

Nobody pays for the services they consume, otherwise, they might as well pay directly and cut out the (expensive, bureaucratic) middleman.

There are two real problems, as well:

- Labour intensive service sectors such as education, health and social care don’t share in productivity gains from the rest of society.

- Baumol’s cost disease shows that service workers demand the same price rises as those in sectors with better productivity.

- The demographics are against us.

- Old people (especially the over-80s) cost even more than schoolchildren, and their numbers are increasing.

The best way out of this is economic growth, but it’s hard to see a post-pandemic government pushing this agenda.

- The Economist wants asset-rich pensioners (ie. the successful ones) to pay for their poorer peers.

But in all likelihood, they have been paying more than their fair share for their whole working lives, and so are unlikely to vote for that.

- So cuts in services are possible.

The Economist thinks this is a bad thing – a strange position for a supposedly liberal paper when taxes are already heading for their highest level since the war.

Mining stocks

In the FT, Merryn Somerset Webb recommended mining stocks for good dividends in inflationary times.

Invest in the things that are causing the inflation rather than just sitting around waiting to suffer from the consequences.

She means big oil (Shell and BP) and mining (BHP, Anglo American and Rio Tinto), but also some smaller names:

- i3 Energy

- Antalya Mining

- Kenmare Resources

- Polymetal and

- Pan African Resources.

Plus the BlackRock World Mining Trust.

Crypto

In the FT, Tim Bradshaw explained that the NFT world is tiny when measured in users rather than dollars.

- “Being early” could last for a long time.

The first supporters of a new project are often rewarded with “whitelist” access before the token goes on sale to the general public. With enough hype, whitelisting can mean paying a few hundred dollars for an NFT that can be resold for thousands just hours later.

But many NFT creators are pseudonymous, making it hard to check their credentials.

- Roberto Nickson put forward a hoax NFT called Kapetta to warn investors of the dangers.

It is less than a year since the first Bored Ape works were minted and just six months since NFT sales exploded last summer. Yet already the company behind Bored Ape, Yuga Labs, is fundraising at a multibillion-dollar valuation. OpenSea, the biggest NFT marketplace, was valued at more than $13bn last month.

Tim contrasts the financial growth of the market with the number of users.

Some $24bn worth of NFTs have been traded to date. OpenSea traded at least $100mn worth of ethereum (the cryptocurrency most commonly used to buy NFTs) every day last month. [But] OpenSea had around 500,000 active users, a rounding error in a global internet population of around 5bn.

It reminds Tim of the launch of Twitter which got a lot of publicity and high levels of adoption in Silicon Valley.

- Years later it remains a difficult-to-monetise minority taste.

The other point about NFTs is the apparent incestuous trading between a small number of users, many of them already wealthy from crypto.

Billions of dollars [are] estimated to be consumed by “wash trading”, a type of fraud that involves selling an NFT back and forth between the same (anonymous) users, in order to pump the price.

Quick Links

I have six for you this week, the first four from The Economist:

- The newspaper said that gold demand has surged in India

- And that Porche and Volkswagen are set to uncouple at last.

- The Economist also looked at America’s next mining boom, sparked by the energy transition

- And said that Space X’s monstrous, dirt-cheap Starship might transform space travel.

- Musings on Markets had Data Update Number Five, on Profits

- And Monevator looked at the financial black hole of later life social care.

Until next time.