Weekly Roundup, 11th January 2021

We begin today’s Weekly Roundup with a look at Hindsight Capital.

Hindsight

At the end of each year, John Authers produces a report from the fictional Hindsight Capital, who always manage to put on the most lucrative trades of the year.

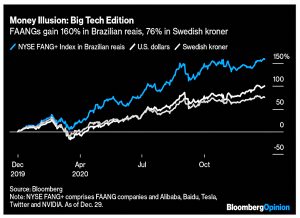

To boost their profits, they always relocate to the country with the weakest currency in order to boots returns.

- This year it was the turn of Brazil.

FAANG stocks were up 160% in reais, compared to only 76% in Swedish kroner (the strongest currency).

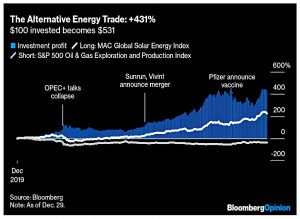

The energy trade was long solar, short oil and gas (+431%)

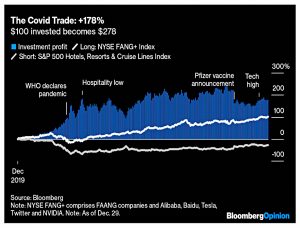

The Covid trade was Long FANG+, short Hotels, Resorts and Cruise lines (+178%).

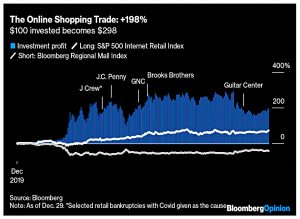

The retail trade was long internet retail, short regional malls (+198%).

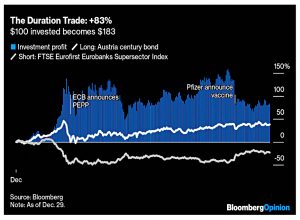

The duration trade was short banks, long the Austrian 100-year bond (+83%).

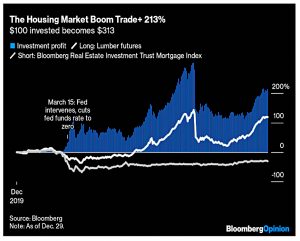

There was also a housing trade – long lumber, short mortgage REITs (+213%).

The crypto trade was long Ethereum, which made 631% in reais (464% in dollars).

- John also looked at commodities trades, driven by China, and at the return of Asian trade, plus a bet on a Biden presidency.

For once, John notes that Hindsight’s trades were somewhat predictable:

Only a few assumptions were needed to make Hindsight’s trades: the pandemic would affect the economy, the West would deal with it far worse than Asia, and the main response would be cheap money. Throw in the implosion of OPEC+, and it turns out most of these trades could have been put on without much hindsight at all.

None of which helps with 2021.

Passive funds

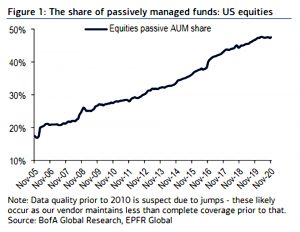

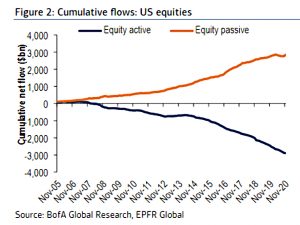

In a second newsletter, John looked at passive funds.

- 2020 was the first year in more than a decade when they failed to gain market share in the US, remaining just below the 50% level.

Money continued to flow out of active funds though not into passive ones.

Active funds did not have a good year in terms of performance, mostly because of their exposure to value, which underperformed once more.

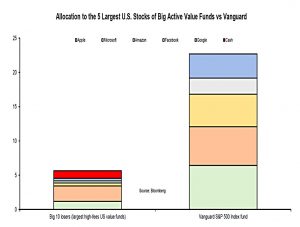

- The top 10 high-fee US value funds were massively under-allocated to the BIg 5 stocks.

But nor was the S&P 500 the best place to be, since three of the biggest winners of the year – Zoom, Tesla and Moderna – were not included.

- For once, the carefully managed S&P (which aims to exclude volatile and speculative stocks) underperformed the Russell large-cap indices (which use market cap alone).

Every investment involves some kind of active decision, and that nothing is truly “passive.” The fact that the epochal switch from active to passive has halted this year (if not reversed) might reflect a growing understanding of this.

And the performance of Tesla, as active managers queued up to “front-run” the passive funds who would be obliged to buy the electric vehicle manufacturer as soon as S&P added it to the club, shows that no index can grow to be as influential as the S&P is now without moving the market it is tracking.

Factor drivers

On ETF Stream, David Stevenson wrote about factor investing drivers in a post-QE world.

- He began with the vaccine bounce in November, which was led at first by cyclical value stocks, rather than the tech growth/momentum firms which had been ahead for the rest of the year.

But his underlying point was that central banks are now very active and likely to remain so:

Who can honestly believe that come the next economic downturn, central bankers will not be raiding the armoury for new monetary weapons and tools – top of the list will be e-money and direct money transfers.

David feels that textbooks written before QE are now out of date. A recent paper by SG concludes:

Since 2009, the cumulative impact of the different waves of QE on US Treasury 10-year bond yields were approximately 180 basis points. Without QE, US Treasuries would have been around 2.8%.

They also estimate that 57% of the Nasdaq price level is explained by QE:

Without QE, the NASDAQ 100 should be closer [in October 2020] to 5,000 than 11,000 while the S&P 500 should be closer to 1,800 rather than 3,300. Small and mid-caps, given their higher payout and lower price to book value ratios, are less sensitive to bond yields.

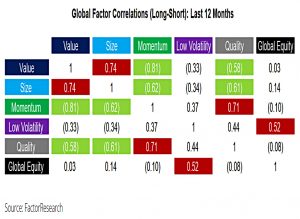

So QE helps momentum and quality but weakens value and (small) size.

David also notes that older, wealthier (male) investors – who can afford to take more risk because of their lower risk non-listed assets (property and DB pensions) – have benefitted most from QE:

They are more willing to invest in less liquid stuff (private equity for instance) or higher rated stocks (tech and growth stocks).

They also have longer life expectancies and therefore a longer time horizon.

- And they have less need for income (dividends) from their risk assets.

Which again favours momentum and quality over value and yield.

Factor Olympics

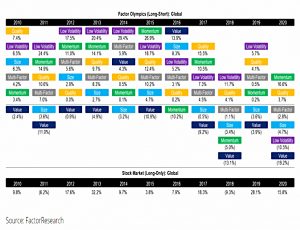

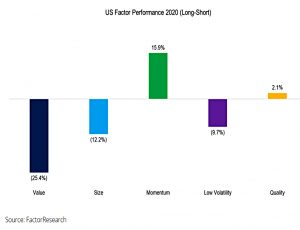

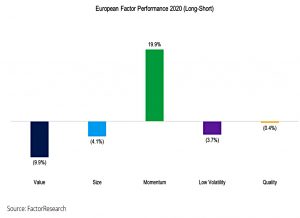

Nicolas Rabener took his annual look at which factors worked last year.

Our factors are created by constructing long-short beta-neutral portfolios of the top and bottom 10% of stocks in the US, Europe and Japan, and 20% in smaller markets. Only stocks with a minimum market capitalization of $1 billion are included. Portfolios rebalance monthly and transactions incur 10 basis points of costs.

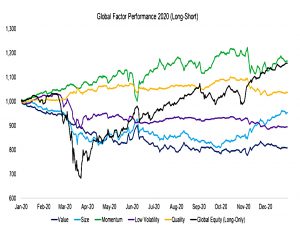

Momentum was the clear winner, whilst value lagged as usual.

Even multi-factor (equal-weighted) has not been very attractive over three years.

But Nicolas rejects the idea that factors are crowded and excess returns have been arbitraged away:

The Value factor is trading at a multi-decade low based on a fundamental valuation and can be considered cheap and uncrowded rather than expensive and crowded.

Low Vol broke a 10-year winning streak.

Being short Tesla or Netflix while long shopping center REITs was not helpful positioning for a pandemic.

The Momentum factor had stronger returns in Europe than in the US despite Europe having a much smaller technology sector. However, the factor performance can also be explained by the short portfolio, i.e. the losing stocks.

Nicolas identifies Tesla as the poster boy for why factors did not do well in general:

The stock is a large-cap, trades at exorbitant valuations, is extremely volatile, and the company features low or negative profitability. Stated differently, the stock has negative exposure to the Size, Value, Low Volatility, and Quality factors.

Only momentum prospers when Tesla and the FAANGs do well.

Direct Listings

Finimize reported that US regulators have approved the direct listing of new firms on the NYSE.

- Unlike IPOs, investment banks (and their fees) can be avoided.

The idea is that investors place bids for the shares, letting the market decide what they are worth.

- Direct listings have been used before to sell shares owned by founders, employees and early investors, but never for new shares.

In a bull market like today’s IPOs for trendy firms will often “pop” to a substantial first-day premium, which means that firms could have raised more money for themselves.

- With direct listings, they would.

This sounds like bad news for private investors since these day one windfalls would disappear.

- But most IPOs are not successes, and on average PIs should benefit.

The downside is that with no investment bank to underwrite the offer and regulate the share prices, there could be more early volatility in the price of directly-listed shares.

Quick Links

I have twelve for you this week, the first three from The Economist:

- The newspaper said that the Chinese trustbusters’ pursuit of Alibaba is only the start

- And told retailers everywhere to look to China

- And explained how to get infrastructure right.

- Alpha Architect looked at whether investors trade on internet postings (spoiler alert – they do)

- And at Value and Momentum and Investment Anomalies

- The FT reported on Stifel’s concerns about the Hipgnosis Songs Fund

- Musings on Markets had a look back at a most forgettable year

- Flirting with Models published their Q4 2020 COmmentary

- SkyBridge published an overview of their Bitcoin fund

- Eli Dourado has some notes on technology in the 2020s

- OSAM looked at Custom Indexing

- And One River Asset Management made the case for digital assets.

Until next time.