Who Owns Your Shares?

Today’s post looks at a recent report from the Law Commission on intermediate securities called Who Owns Your Shares?

The Law Commission published its scoping paper on intermediated securities – called Who Owns Your Shares – on 11 November 2020.

The purpose of the scoping paper is to inform public debate, develop a broad

understanding of potential options for reform and develop a consensus about issues to be addressed in the future.

The scoping paper is in response to a call for evidence in 2019.

- It identifies issues for investors and businesses that might need attention in the future – we’ll obviously concentrate on the former.

Detailed recommendations for reform are not included in the scope of the report, and nor are pooled funds.

This is a topic that we first looked at back in 2015 when we reviewed a paper from ShareSoc called Reforming UK Share Ownership.

- ShareSoc is the UK Individual Shareholders Society, a non-profit company funded by donations and membership subscriptions.

- Its aim is to support individual private investors, keeping them informed and educated, and acting as a lobby group on their behalf.

- ShareSoc believes that the long-term decline in the UK of direct holdings of shares has reduced corporate governance and shareholder democracy.

Back in 2015, they had several recommendations:

- A modern low-cost system of share registration for direct use by retail investors should be established

- Retail clients must be informed of their loss of rights under nominee accounts and offered a direct alternative (an opt-in)

- All nominee operators must provide options with full rights

- Tax-beneficial accounts (SIPPs and ISAs) must support direct holdings as well as nominees

- Low-cost communication to all beneficial holders of shares in a company should be possible

- The Companies Act should be revised to match the above recommendations

Heading back to 2020, the lack of direct ownership has impacted ordinary shareholder involvement in the many emergency fundraisings carried out in response to the Covid crisis.

- Most of these have involved the circumvention of pre-emption rights in order to allow institutions to quickly fund these raises.

The intermediation solution needs to solve problems like these, too.

The problem

As the new report says:

Not all investments are straightforward to own. If you buy a gold bar, you own the gold bar. If you buy a piece of art, you own the painting or sculpture. If you decide to buy securities, such as shares or bonds issued by a company, the position is more complicated.

When I started buying shares, you often had to fill in a paper form, and at the end of the process, you would be sent a paper share certificate.

- This procedure still exists for VCT subscriptions but has otherwise disappeared.

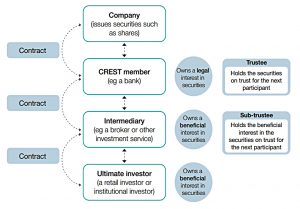

Now share ownership is recorded in the CREST system via nominee accounts owned by intermediaries such as banks, brokers and investment platforms.

- The benefits are that you can trade online, the settlement is quicker and commissions are lower due to economies of scale.

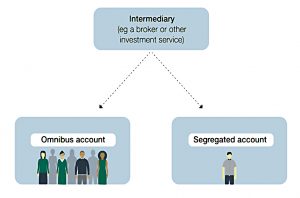

An intermediary will often hold your beneficial interests in securities in an “omnibus”

account, pooled with the investments of other clients. One omnibus account may

hold millions of shares for investors. Some intermediaries also offer “segregated”

accounts, which hold the assets of one particular investor only.

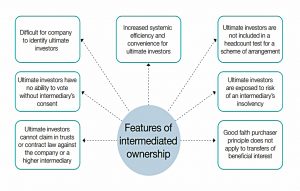

But there are issues of transparency (who is the beneficial owner?) and corporate governance (the ability for shareholders to exercise voting rights and be included in schemes of arrangement) and legal uncertainty surrounding the insolvency of an intermediary.

- Technically, investors do not “own” their shares.

As an ultimate investor, your name will not appear on the register of members and you are not a member of the company. You will not automatically have a direct relationship with the company.

Even where an ultimate investor is able to vote, they may find it difficult to confirm that their vote was received and counted by the company.

Instead, the financial institution (the “CREST member”) at the top of the intermediated securities chain will be the legal owner of the investments and the legal shareholder or member of the company. They will receive information and correspondence from the company, be able to attend company meetings and vote in relation to the shares.

Rather than being the legal owner of the investments, the “ultimate investor” is instead the owner of a “beneficial” interest in the investments.

- This makes it difficult for the beneficial owner to pursue the share issuer (the listed company) in law since they only have a contract with the intermediary (the nominee account operator).

For these reasons, many private investors prefer to stick with the largest brokers and platforms.

- And those investors who, like me, dabble with the newer (and smaller) brokers, prefer to stay under the FSCS compensation limit of £85K with these brokers.

Interactive Investor polled more than a thousand visitors to their website about their voting habits at company AGMs:

- 62% rarely if ever voted

- only 6% said the always do

- 53% would like to vote

- 25% were interested in voting on ESG issues

- 22% were interested in voting on executive pay

- 30% would be more likely to invest in a company where they could affect how it was run through their voting

Potential solutions

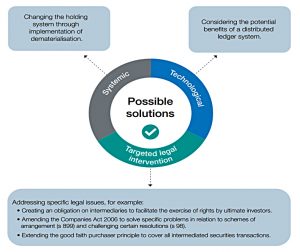

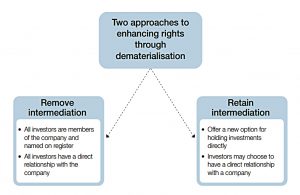

There are three types of possible solution:

- The legal solution to the corporate governance issues would be a new obligation on intermediaries to arrange, upon request, for an investor to receive information, attend meetings and vote (this is optional at present).

- If would be helpful if beneficial owners could also nominate proxies (other than the intermediary) on their behalf.

- A similar solution – the one preferred by shareholder organisation ShareSoc – would be for every beneficial owner to have the legal right to have his name and address on the register as the member, and hence to have access to member rights under the Companies Act.

- A third version would be to convert nominees to agents of the ultimate investor, separating the provision of (brokerage and custody) services from ownership.

- A structural intervention would be to remove intermediation or alternatively provide the option for investors to hold their own investments (along the lines of a free private CREST account).

- A technical solution would be something like a distributed ledger technology (blockchain, for example).

Since intermediation provides benefits, it is probably better to improve the system rather than to remove it.

Conclusions

There’s not much to disagree with in the new report, but the glacial pace of change in the area is stunning.

- It’s hard to believe that five years have passed since I reviewed the ShareSoc paper, during which time nothing has happened.

So I won’t hold my breath that this new paper will make a difference.

- Until next time.