Weekly Roundup, 22nd August 2022

We begin today’s Weekly Roundup with the Amazon fallacy.

Amazon fallacy

John Authers looked at a paper from Cliff Asness of AQR on the relationship between value stocks and bond yields.

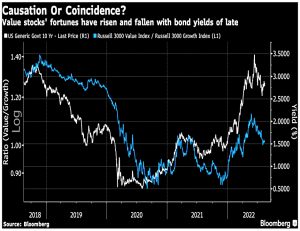

For the last few years, it’s certainly been the case that value has tended to beat growth when yields are rising, and underperform growth when yields are falling. For more than a decade, we’ve been accustomed to low bond yields and underperforming value stocks.

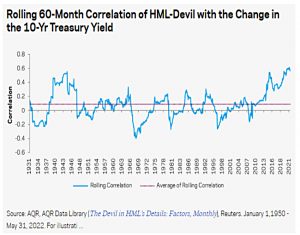

The chart above shows that the relationship has been very close, but over 90 years, the correlation is all over the place and has never been particularly high.

It has been at its highest over the past decade.

This has been interpreted as a duration effect:

Growth stocks’ value is piled up in cash flows a long way into the future, and thus they are a longer “duration” asset. A rise in interest rates, increasing the rate at which those future cash flows should be discounted, should have a much bigger effect on them than on value stocks.

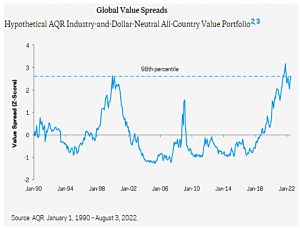

As rates fell during Covid, the spread of growth stock prices over value stock prices increased to a record level, even bigger than during the dot come bubble.

- There was a correction at the start of this year, but the spread is back up to dot com levels once more.

John makes the same point with a chart of the PE spreads between growth and value indices.

Despite this, the BoA survey of fund managers says that – for the first time since August 2020 – a majority think that growth will out-perform.

- This could reflect mean reversion fears after recent value outperformance or worries about a slowdown in the US housing market.

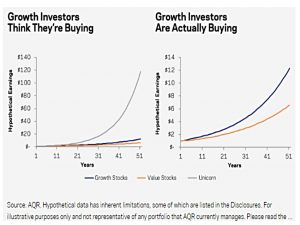

Getting back to duration, Asness thinks that idea is based on a misconception that all growth stocks will behave like unicorns.

John goes one step further and names this the Amazon fallacy:

You could have made plenty of money by buying Amazon.com Inc. shares at the top of the dot.com bubble in 1999 and 2000. Lots of things were to break right for the company over the decades that followed, and it would also grab opportunities then unthought of, such as cloud computing.

But there’s only one Amazon.

The success of Amazon cannot be replicated by many at any one time. There can only ever be few startups that go on to build a large and well-defended monopoly. Asness’ point is that growth investors are behaving as though all growth stocks can be Amazon, and they can’t.

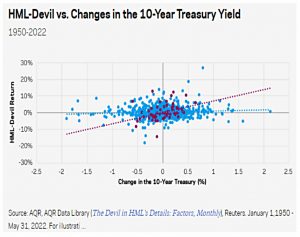

Asness also runs through the duration calculations:

A duration of 10 years means that a 100 basis point fall in rates would, to a linear approximation, lead to a 10% increase in market value. The “duration” of the growth portfolio (blue line) is 0.4 years longer than the duration of the value portfolio. If you think that’s trivial, you are correct.

A true unicorn, on the other hand, has a duration which is 10 years longer and this is material.

If investors in 1999 had had an accurate grasp of Amazon’s future cash flows, its share price should have been very sensitive to interest rate changes.

So your ability to exploit the duration effect depends on your ability to identify the next Amazon.

- Good luck.

Insiders are buying

John now has someone helping him out with his Bloomberg newsletter – her name is Isabelle Lee.

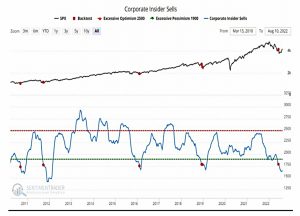

- Recently she looked at SentimenTrader’s work on insider sentiment.

As the market fell this year, buying picked up. Research director Jay Kaeppel said:

Since 2010, readings of this level or higher have been followed by higher stock prices 12 months later 98% of the time. Generally speaking, a quick and dramatic pickup in buying tends to be an excellent sign for the stock market.

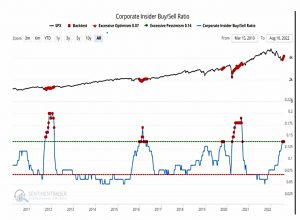

Lack of insider selling is also a good signal, as is the buy/sell ratio:

We’re not quite at pandemic levels for the ratio, but on previous occasions, the current value has been a good buy signal. Kaeppel says:

Insiders tend to have a one-to-two-year time frame. When you see a period of insider accumulation, it tells you two things: 1) that insiders are anticipating improved fundamentals (higher sales and earnings), and 2) history suggests following their lead.

Bull Market or Bear Rally?

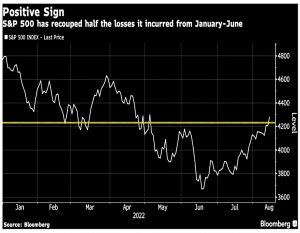

In a second newsletter, Isabelle looked at whether the S&P’s recovery of 50% of its January to June losses means that:

- we have a new bull market on our hands, or

- simply a sizeable rally in a bear market (with new lows to follow).

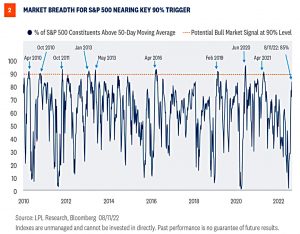

The recovery has breadth – close to 90% ofS&P stocks are above their 50-day MA.

- In 2009, 2011, 2018-2019 and 2020 this was a signal for a new bull market.

These breadth thrusts usually happen (median) around 1.8 months after the bear market low, so in this case on Thursday 11th August.

- We have until the mean date of 6th September (2.7 months after the low) to hit the 90% target.

Note that this 50-day MA signal failed to fire in 1978, 1987, 1998, and 2001.

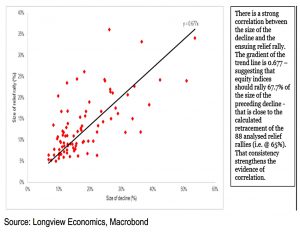

Longview Economics takes the opposite position – 88 previous relief rallies (across seven indices since 1996) have gained an average of 65% and lasted an average of 37 trading days.

- This suggests that the current rally is running out of road.

Isabelle also notes that summer is quiet in the markets and that late August and early September are not traditionally good periods for stocks.

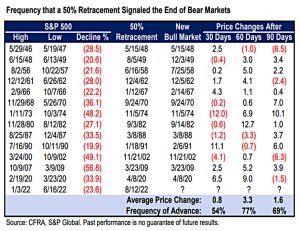

CFRA research looked at performance 30, 60 and 90 days after a 50% retracement:

The ‘500’ had a tendency to digest some of the gains after reaching the 50% threshold, or recording a new bull market, as the average frequency of advance (FoA) was only slightly better than that of a coin toss at 54%. Two and three months later, however, the S&P 500 posted FoAs of 77% and 69%, respectively.

The other issue is the economic environment – bull markets don’t usually start before the Fed tightening cycle ends.

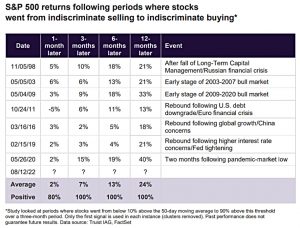

But as Truist IAG point out, a flip from selling to buying like this usually means more gains ahead.

Isabelle concludes:

Looking at behavior in the stock market, this looks like the bear market is over. Looking at the monetary policy cycle, it’s far too soon for a new bull market. The reason for the contradiction is simple enough: a oncein-a-century pandemic.

I’ve been bearish for a few months now, but the longer this rally continues, the harder I find it to maintain that stance.

Art

In his Adventurous Investor column in the FT, David Stevenson looked at the fractional ownership of art.

- In particular, he examined the Masterworks platform, which we looked at more than a year ago.

Masterworks selects an artist and artwork, choosing what it thinks has the greatest “momentum”, then buys and securitises it before selling portions on its platform.

It warns investors they may be waiting between 3 to 10 years before it subsequently sells an artwork and they can take their profits — unless they find a willing buyer for their stake before on its secondary market.

There is an annual charge of 1.5% and a 20% levy on any profits from the eventual sale.

- There are also potentially chunky (20%?) auction house fees on purchases, though Masterworks often buys directly rather than through auctions.

Masterworks [has] been involved with more than 120 paintings (involving over 30 artists) and invested over $500mn plus in acquisitions since inception and expects to acquire roughly $1bn of art in 2022.

Returns on art have been good (often better than stocks and property, as well as better than gold and inflation).

- But this may not be the best time to buy, as wealthy art collectors may have less money to play with in the near future.

It should also be noted that every artist and every artwork is a micro-market.

- Contemporary art is the riskiest market, but might also potentially deliver the greatest rewards.

A third point is that Masterworks has only a handful of sales to date, relying on a database of global sales to revalue its inventory.

For all these reasons, diversification is key, which is where fractional ownership comes in.

In a follow-up from his Substack newsletter, David noted that Masterworks has a UK competitor called Mintus.

- I’ll look into this platform and report back.

IPOs

In the FT’s Alphaville column, Bryce Elder reported on the terrible track record of recent UK IPOs, inviting us to guess which had done the worst:

Made.com? Excellent answer. The delayed-gratification furniture specialist was down 76.6 per cent even before Thursday’s open, ahead of which it warned it’s considering an equity raise. That’s after burning through most of the £100mn new money it raised in June 2021.

There are, however, worse. ProCook? Deliveroo? THG? Down 71.6 per cent, 75.5 per cent and 76.7 per cent respectively. Shockers all, but there are still worse.

Award yourself a point if you said MusicMagpie (-77.2 per cent), Guild ESports (-79.5 per cent), Victoria Plumbing (-80.6 per cent), In The Style (85.3 per cent), Revolution Beauty (88.4 per cent) or Seraphine (91.8 per cent).

But the IPO crapco title goes Parsley Box, an ambient ready-meal delivery thing, which is down an exciting 94.6 per cent since arriving in March 2021.

Commiserations is you bought into more than one of those.

The 140 companies listed since the start of 2020 are down an average of 38.3%, compared to the US average of 12%.

- It seems that the bad news is filtering out, as listings are down 45% in 1H22 compared with the previous year.

Quick Links

I have six for you this week, the first two from The Economist:

- The Economist wondered whether the EV boom could run out of juice

- And explained how to encourage electric car use.

- Alpha Architect looked at mining credit card data for stock returns

- And at alpha from short-term signals

- And at whether relative sentiment is an anomaly.

- UK DIvidend Stocks published their half-year update for 2022.

Until next time.