Weekly Roundup, 5th March 2019

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about buy to let.

Contents

Buy to let

James Pickford reported that the proportion of home sales that go to buy to let landlords is shrinking.

- Their share was down to 11.4% in 2018, down from 18.7% in 2011.

- They borrowed £9 bn during the year, down 15% on 2017.

- In London, the landlords share of sales rose from 17% on 2017 to 19% last year.

This is hardly surprising, given the disadvantageous tax changes of recent years.

- Tax relief on mortgage interest is being phased out.

- And there is a 3% stamp duty surcharge on new homes.

- And a portfolio viability test for those with four or more properties.

According to James, the government is worried that forced sales by leveraged landlords would exacerbate the next property downturn.

- If so, they’ve taken a belt and braces approach, since they’ve also kept interest rates low and introduced the Help to Buy scheme (see below), both of which keep property prices high.

Help to buy

Merryn Somerset Webb says that Help to Buy is building a legacy of misery.

- £10 bn has been loaned to 200K people (at an average of £55K each).

- The maximum loan is 20% of a £600K home, or 40% in London (£240K).

Apart from the low cap (there are no flats near me for £600K), the other odd restriction is that its new-build only.

- Which means mega-profits for housebuilders.

- And paying over the odds for shoddy housing for the people who use the scheme.

Help-to-buyers pay 6-7% more than ordinary new-build buyers, and new builds are over-priced by 16% to begin with.

- And after five years, they start to pay interest on the loan at 1.75%, indexed at RPI+1%.

And since it’s an equity loan, they owe a share of any profits when they sell.

- Which could mean that they can’t afford to buy the next rung on the property ladder, sending them back to square one.

Merryn compares it to QE, and like QE, the problem becomes how to safely switch it off.

- She says she wouldn’t buy the big housebuilders on moral grounds.

I wouldn’t quite go that far (since it’s a government scheme) but I don’t own any directly, and if I did, I would keep quiet about it.

Long term focus

Ken Fisher was back in the FT with his regular stock market pep talk.

- His advice this time was to ignore the data overload and focus on the long term.

He was writing specifically about the bad UK GDP figure for December (4Q18 as a whole was fine).

What matters isn’t if December fell, but whether weakness sticks.

Ken puts the dip down to falling oil prices and Black Friday promotions pulling retail spend into November.

- January retail showed a rebound.

Almost one in every four months since 1997 showed negative GDP growth. Yet GDP has contracted in only seven quarters, with only one recession.

Before last summer, the public had no reason to fret about monthly GDP figures — because there weren’t any.

Ken expects a positive reaction to Brexit from the UK markets – whatever the detailed outcome.

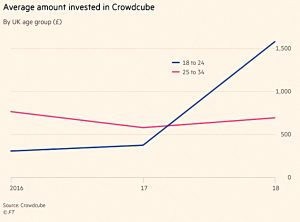

Crowdfunding

Nikou Asgari took a sceptical look at crowdfunding.

- I share the scepticism.

EIS and VCT are fine for those who have maxed out their pension allowance (or indeed, their entire pension, courtesy of the stupid LTA).

- But that isn’t the crowd that the funding platforms attract with their £10 investment minima.

According to Nikou, It’s young people looking for the next unicorn ($1 bn value unlisted firm).

- Tech and food and drink are popular sectors, inspired by success stories like Revolut, Monzo and BrewDog.

The people she interviewed claim to be attracted by the transparency of the pitches and personal experience of the products involved.

- I suspect that a lack of understanding of the risks, an overestimation of the potential rewards, the ease of investing (online, low minima) are the real drivers.

- The Instagram-friendly nature of the companies involved and the behavioural bias towards long odds gambles don’t hurt, either.

The odds are not in the investors’ favour – there have been only nine exits from Crowdcube to date, and 16% of crowdfunded investments between 2011 and 2018 have already gone bust.

- And – like P2P lending – there’s no FSCS protection.

- There’s also no liquidity – there’s usually no secondary market, so you need to wait for a successful exit.

- And your holding can be dilute by later investors.

VC, PE and micro-caps in general are not for widows and orphans – or millennials with just a few thousand pounds to their name.

- But this is the kind of investing lesson that people probably need to learn for themselves.

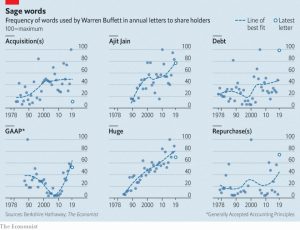

Buffett’s letters

Last week we looked at the latest of Warren Buffett’s annual letters to shareholders.

- That makes eleven in total that we’ve reviewed – you can find all the articles here.

This week, the Economist has dug deeper, performing a textual analysis on forty years of the letters.

The note the following:

- As BRK has grown, use of “businesses” rather than “business” and “huge have increased.

- Warren’s moans about GAAP (accounting rules) have soared.

- Mentions of “repurchases” (stock buybacks) have increased.

- Those of “acquisitions” have not.

- “Debt” is on the increase (BRK borrowed to buy part of Kraft Heinz).

- And so is “Ajit Jain”, Warren’s likely successor.

Not bad for a few charts.

3G Capital

Sticking with Buffett, The Economist had an article on 3G Capital, his partners in the Kraft Heinz deal.

- Kraft Heinz announced quarterly losses of $12.6 bn a couple of weeks ago.

The newspaper wonders if this is the end for its debt and cost cutting strategy (par for the course in private equity).

- 3G-run firms owe $150 bn in total.

3G tends to buy firms with popular brands and oligopolistic market share.

- If sales can be expected to remain steady, increased leverage and cost-cutting should boost returns.

Unfortunately:

Consumers are getting more fickle and are switching to independent beer brands and healthier food. Supermarkets are promoting cheaper white-label brands while e-commerce has given a leg up to insurgent brands.

The Economist sees Kraft Heinz as a microcosm of corporate America:

Although sales have been sluggish, 66% of firms in the s&p 500 index have raised their margins and 68% have raised their leverage since 2008. A mania for deals in mature industries, premised on debt and austerity, is in full swing.

SIPP market

In FT Adviser, Maria Espadinha wrote about the FCA rules that could shrink the non-advised SIPP market.

- As part of its Retirement Outcomes Review, the FCA has proposed that pension providers must offer a choice of “investment pathways”

Providers who are focused on advised consumers could withdraw from the non-advised market to avoid the cost of introducing the pathways .

If so, it wouldn’t be the first time that regulation introduced to protect the weak has ended up hurting the strong:

- The outlawing of commissions as payment for advice means that those with small pots now receive no advice at all.

- And the requirement for holders of pension pots over £30 to pay for transfer advice means that such advice is not cheaply available.

Quick links

I have eight for you this week:

- The Times revealed the real risk of Woodford’s funds.

- The Collaborative Fund asked What Else Matters?

- Alpha Architect explained that low volatility can be low turnover.

- Bloomberg looked at recent problems with trend following.

- UK Value Investor asked whether BAE Systems is good value.

- Adventurous Investor asked what the hedge funds have been buying.

- And presented the charts flashing “one heck of a warning sign“, and

- Musings on Markets looked at the Perils of Investing Idol Worship.

Until next time.