Weekly Roundup, 11th July 2022

We begin today’s Weekly Roundup with commodities.

Commodities

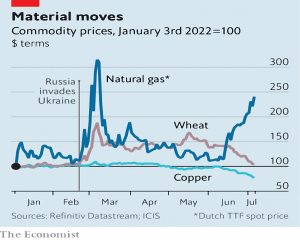

The Economist wondered whether cheaper commodities were signalling a recession.

Oil is trading at around $100 a barrel. Copper has dropped below $8,000 a tonne for the first time in 18 months; metals in general have fallen by 10-40% since May. Agricultural-commodity prices are back at pre-war [in Ukraine] levels.

The idea is that rising interest rates are choking demand for housing (copper and wood) and clothing, appliances and cars (aluminium and zinc).

- The weather in grain-growing regions has also improved and there are ongoing attempts to export Ukraine’s wheat.

- Speculative money is also leaving commodities as long-dated real rates have now turned positive, highlighting the lack of a yield from commodities.

All this might mean that rate hikes can end early as inflation falls and that any recession would be mild.

But the threat of future energy shocks remains, and high energy costs will depress the production of other commodities (particularly metals).

- So prices could remain high through the recession.

50-year mortgages

A few days before he was forced out of office, Boris Johnson said that the government was looking at longer-term mortgages (later described as 50-year mortgages) that could be passed from parents to children.

Central bank governor Andrew Bailey said:

Our approach is that we will support and engage in any process which wants to envisage innovation in the market. It’s something we would certainly support a review of to see what is possible in the market. If it comes forward we will certainly play our part in it.

The BoE’s financial stability report mentioned the US and French markets, where loans are fixed for their duration:

Households with such mortgages are less exposed to rises in interest rates.

Prudential Risk Authority CEO Sam Woods said:

There are other non-UK markets which function perfectly well which do have much longer, fixed-rate mortgages. I think not often 50 but much longer than we’re used to.

So I think if such a product came forward in the market we’d approach that with an open mind. Our job would be to make sure the prudential regulation could be adapted as needed to capture any risks that came with that.

Let’s see if the policy survives the leadership election.

Mortgages longer than 25 years are not standard in the UK (and indeed, most UK mortgages are floating rate, or fixed for around five years) but Japan has mortgages stretching out to 100 years.

- Of course, Japan has a different attitude to intergenerational living than does the UK.

There was a predictable reaction from people who think that the answer to high house prices is to build more houses.

I’m in favour of more houses (assuming that design and build standards could be raised), but there are a few problems with this view (note that I have a fair amount of money in property, so I can’t claim to be unbiased):

- There are a lot of empty and cheap properties in the UK – they just aren’t where people want to live and work

- Building more properties in the (expensive) places where people want to be is not cheap (or necessarily efficient)

- The availability of cheap finance is a bigger driver of house prices than the supply and demand of the actual dwellings

- The UK can’t afford a house price crash – most people have the majority of their wealth in their homes and a crash would break the economy (and probably make the high-street banks insolvent)

On balance, I’m in favour of supporting the housing market, but I wouldn’t have started with 50-year mortgages.

- Longer-term fixes than are currently widely available (say 25- and 30 years) would seem more useful.

50-year mortgages would be cheaper, to begin with – though they involve paying more over the lifetime of the loan).

- This would mean that less well-off people would pay more for their houses, but at least more people would own a house.

And whilst the children might prefer not to take over the repayments, the option could be better for some than a lifetime of renting.

- On the other hand, it wouldn’t be a home of your choosing, and would likely need some re-working.

But if passing on the house was made easy within the tax system, it could be sold and the equity re-cycled.

PensionBee

The row between PensionBee and other pension providers rumbles on, with PensionBee reporting a number of them to the DWP for exploiting regulatory loopholes to delay pension transfers.

- The providers include The People’s Pension, Cushon, XPS and Railpen.

The first two are relatively new workplace pension providers (so I am surprised PensionBee has much business with them), but I’ve never heard of the others.

- I expected the old insurance companies and fund managers to be the troublemakers.

The regulation being exploited allows providers to flag a transfer as having a high scam risk, which is unlikely to be the case for a transfer to PensionBee.

- In response, the People’s Pension provider B&CE has said that PensionBee’s marketing schemes fall outside the regulations and therefore must be flagged.

XPS reported in February that it was red-flagging 50% of transfers, and by March this figure had risen to 76%.

PensionBee CEO Romi Savova said:

It’s appalling to see pension schemes abuse regulations to prevent savers from moving their retirement savings to their provider of choice. This type of behaviour is unacceptable for any institution, but particularly for companies that have been entrusted with savers’ hard-earned pension savings.

Providers cannot hide behind new legislation to justify the disappointing rise in pension transfer times and must remember the impact their decisions have on the consumers they are meant to serve. [Regulators should] take pension transfer times seriously and introduce a 10-day pension switch guarantee, a time frame the ombudsman is independently enforcing.

XPS MD David Watkins said:

XPS Pensions Group is not hiding behind regulations to unnecessarily delay transfers. The regulations which came into force last year are about protecting members from the ever-increasing prevalence of scams. There is widespread recognition in the industry that they are not perfect and that there are some issues still to be resolved.

We are actively working with government and industry partners to seek a change in the regulations that would make routine transfers operate more smoothly. Until those amendments are made, we will continue to abide by the regulations as they are written, taking into account legal advice we have received. XPS Pensions Group will always prioritise the safeguarding of members’ savings over commercial considerations.

Railpen said:

In November, following the introduction of new regulations, Railpen adapted its approach to member transfer requests. Our primary aim is to protect our members, and while we understand that these steps have added some time to the transfer process, we are focused on keeping our members, and their money, safe.

Cushon said that PensionBee’s “refer a friend” scheme was the issue:

The regulations are clear that an incentive to transfer is a red flag and where an incentive has been given, a statutory transfer cannot be permitted. We are able to allow non-statutory transfers, but in these instances the trustees are required to apply more stringent checks and follow more robust processes to ensure members’ interests are protected.

The trustees have also written to the minister of pensions and financial inclusion to request clarification on the regulations in light of the legal advice we have received.

The minister for pensions resigned last week, and it looked as though they might be waiting a while for a response – but now he has been reappointed (on an interim basis).

Savova said:

On several occasions, the DWP has clarified the intention of this legislation. The pensions minister even set out the definition of an incentive as a ‘too good to be true offer’ such as free pension reviews or early access to pension cash.

It is clear that commonly used referrallike programmes, which are offered by many of the largest pension providers in the country, are not a cause for concern or sufficient reason to delay consumers from moving their own money.

It will be interesting to see which side of the fence the DWP comes down on.

- We have a “small pot” problem in the UK, so I’m in favour of easy consolidation.

- We also have a lot of gullible pot owners who are vulnerable to scams.

Surely a “white list” of pre-approved providers who are known to be suitable to receive transfers would speed things up?

The Pension Regulator agrees:

Trustees may wish to retain records of “low-risk personal pension schemes”, which they can use to oversee some transfers without an onerous administrative burden. These may allow you to maintain a smooth transfer process where due diligence analysis shows no risk. [Trustees] “may determine that the transfer can proceed without the need for additional checks.

Quick Links

I have five for you this week, the first four from The Economist:

- The Economist said that private equity might be heading for a fall

- And explained why leveraged buy-outs are in trouble

- And wondered whether companies can pay their debts as interest rates rise and the economy cools

- And profiled crypto’s last man standing.

- Alpha Architect examined whether intangible-adjusted book-to-market works.

Until next time.