Weekly Roundup, 25th July 2022

We begin today’s Weekly Roundup with capitulation.

Capitulation

John Authers looked for signs of capitulation in the markets.

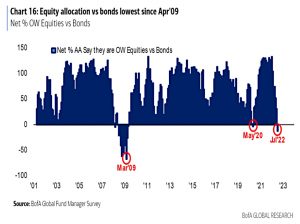

- His first exhibit was the underweight in stocks from big fund managers:

This is the largest since March 2009, the market bottom following the 2008 financial crisis.

After the last two underweights (2009 and the Covid lockdowns in 2020) we had subsequent stock rallies.

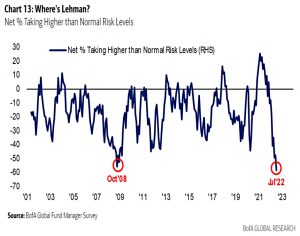

The same managers also think that they are taking less risk than at any time since the survey began 20 years ago.

To an extent this survey suffers from the same in-built bias as the poll that discovers a strong majority of drivers think that they drive more safely than average.

Most of the time, BofA’s managers think they are taking less risk than usual, and there are times when they are wrong about this. However, it seems reasonable to assume that the survey is directionally accurate.

Back in 2008, this signal came five months early.

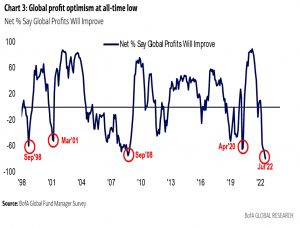

John also looked at company profits, expectations for which are at an all-time low.

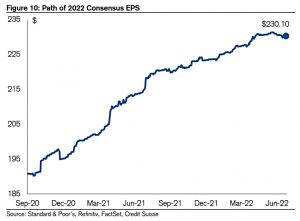

Consensus earnings estimates are surprisingly much better, flattered by the energy sector.

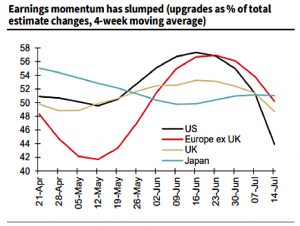

But momentum (upgrades vs downgrades) has slumped, particularly in the US.

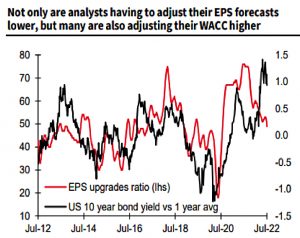

And rising interest rates mean that the weighted average cost of capital (the WACC) has to be adjusted upwards.

This is an unusual and unwelcome development at a time when the economy is in danger of recession. But there’s also reason to think that the official data might be misleading.

Brokers might still have relatively optimistic earnings forecasts, but money is generally being deployed by people who are far more bearish. At times like this a little good news can go a long way.

Balance Sheets

The Economist looked at balance sheet management as economic circumstances change.

Since the financial crisis, historically low interest rates have allowed firms to borrow cheaply and plentifully. High profits have been returned to shareholders instead of being used to boost investment. Now a new economic chapter has begun, marked by squeezed profits and pricier debt.

In the balance sheet, debt has a benefit over equity in that interest payments are usually tax-deductible.

- But borrowing too much increases the risk of financial distress.

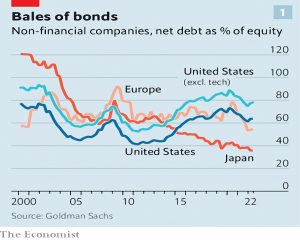

The US has been on a borrowing binge.

Average indebtedness has risen to three times earnings before interest, tax, depreciation and amortisation (EBITDA), from 1.6 times in 2010.

The number is even worse if cash-rich tech is excluded.

This is not necessarily a problem, since rising interest rates won’t immediately affect locked-in lower rates on the borrowing.

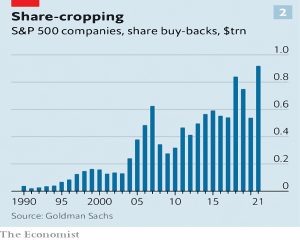

- So dividend payouts and share buybacks are continuing.

So long as markets stay stormy, CEOs will be reluctant to rein such payments in, lest this be interpreted as signalling distress.

It will probably be the need for investment that ends shareholder payouts.

The share of operating cashflows reinvested by American firms in new capital expenditure and research and development has declined over the past decade to 27%, from over 40% in 2009.

Following the pandemic, this percentage will likely need to rise again.

- Firms need to spend more on inventories, to help cope with supply-chain problems, which leads to a requirement for more working capital.

- Re-shoring/onshoring will mean more investment.

- And reducing carbon emissions will cost money.

Returning capital to shareholders and investing it are two sides of the same coin: capital which cannot be invested at a rate exceeding its cost should be handed to shareholders, who can put it to better use elsewhere.

Dividends and share buy-backs are not, on this view, backward-looking celebrations of high profits. They are a forward-looking pursuit of shareholder value.

Pensions

In the FT, Merryn Somerset Webb said that we must reform the Roman invention of pensions.

In 13BC Caesar Augustus put in place a system — financed from taxation — that paid all those who had served for 25 years a lump sum equivalent to 13 years of salary.

Merryn calculates that the UK’s auto-enrolment workplace pension will provide around the same amount after 30 years of contributions.

- It sounds like the Roman system was more generous until you factor in the average life expectancy at the time was just 41, whereas more than half of UK children born today are expected to live past the age of 100.

This is good news for the individuals concerned, but bad news for the dependency ratio of retirees to workers.

- This in turn suggests that people will need more significant private provisions to top up state funding for pensions and medical costs.

The parliamentary group on financial resilience is proposing a mid-life MOT in one’s 4os or 50s to prepare workers for retirement.

- I think this is probably too late – the real issue is getting people into the savings habit from the moment they start earning.

And solving that one isn’t easy:

There is much talk these days of teaching schoolchildren about personal finance. But it is often ineffective. Kids mostly don’t remember these things when they actually need to know them. If you are taught about mortgages at 15, do you really know anything about mortgages at 30?

Merryn likes the idea of “just-in-time” education, but I think we need compulsory savings.

- Auto-enrolment is a start, but there is an opt-out and the contribution rates are too low.

Haleon

The Economist looked at Haleon’s demerger from GlaxoSmithKline as an illustration of the problems facing the London Stock Exchange.

Haleon is not a fast-growing technology or life-sciences firm. It is a long-standing business selling Sensodyne toothpaste and smartly packaged ibuprofen.

The UK’s share of capital raised in IPOs globally this year has fallen to just 1%, and much larger firms have been listed in New York and Hong Kong.

The Economist identifies two reasons for the LSE’s decline:

- Twenty years ago British defined-benefit pension funds had around half their assets in London-listed equities; today the share is less than 3%.

- [And] tech firms worry City investors are too focused on short-term profits to take their businesses seriously.

I agree with each of these, but a bigger problem in attracting tech firms is the higher ratings offered on markets like NASDAQ – there’s no easy way to fix this.

Inflation targets

The Economist also looked at whether the inflation targets used by central banks should be raised.

- The 2% figure which is currently popular across the rich world dates back to a 1989 announcement from the New Zealand parliament, and it could easily have been 1%.

This might seem a strange time to ask since central banks aren’t sticking to their existing targets, but:

Raising the target might help prevent rich countries from returning to the low-inflation, low-growth malaise that was the rule for the decade after the global financial crisis.

High inflation gets in the way of two of money’s three functions – acting as a unit of account and as a store of value.

Contracts lose their worth rapidly, redistributing income and wealth arbitrarily between buyers and sellers or between creditors and debtors. Long-term investment and saving decisions become more of a gamble.

But deflation is arguably worse – economic activity slows and debts become bigger in real terms, which can lead to depression.

Perhaps a 3% or 4% target would be best?

Economists have struggled to identify differences in the costs to an economy from different stable, low-single-digit inflation rates.

A higher target would help interest rates to be negative in real terms, yet stay above nominal zero, where they cease to be fully effective (depositors can hold physical cash instead).

- This is what led to the use of QE as an alternative.

Higher inflation targets should also require lower levels of unemployment before they are reached.

The counterargument is that the public clearly hates inflation, and has had a 30–year promise that it will be kept below 2%.

- So a higher target will need selling – but this will be easier on the way down from 10% than on the way up from zero.

VCTs

The sunset clause on VCTs and EIS that was insisted on by the EU as part of its State Aid rules comes into play from April 6th 2025, and industry commentators are beginning to ask for clarity on the future direction for these products.

- A Treasury committee is currently holding an inquiry into the role of VCTs in the UK’s venture capital industry.

Wealth Club (( My own VCT broker )) ran a survey of 1,309 VCT investors in early July and 90% said they would invest less (or nothing at all) if the tax breaks were cut, and 99% would not invest if there were no tax breaks at all.

- VCTs currently offer 30% income tax relief (if held for five years) and tax-free dividends.

In return for these breaks, the two products raise more than £1 bn in start-up funding each tax year.

- Industry body VCTA says that VCTA-backed businesses delivered £12.5bn in revenues and £3bn in exports over the last financial year.

Wealth Club CEO Alex Davies thinks there is a real chance that VCTs in particular might be discontinued:

Critics question whether VCTs are good value for money, if investors would continue to invest without the reliefs and whether VCT investments are sufficiently risky to justify government support. Our research shows that is just plain wrong.

Policymakers should take a longer-term view on any such decisions, as years of good work could be quickly undone and the UK could lose its status as the start-up capital of Europe.

Quick Links

I have nine for you this week, the first four from The Economist.

- The Economist said that the Fed put has morphed into a Fed call

- And that the yen looks cheap as chips

- And described the 53 fragile emerging economies

- And reported on the opening of a superhighway for drones between Bristish cities.

- Alpha Architect looked at Relative Sentiment and Machine Learning for Tactical Asset Allocation

- And said that short sellers are informed investors

- And looked at research into individual investor behaviour.

- The FT reported that half a trillion dollars have been wiped from fintechs

- And UK Dividend Stocks said that the bear market has left the FTSE-250 CAPE below fair value.

Until next time.