Watch the metrics

In the FT, Simon Samuels – a banking consultant at Veritum Partners – viewed the current crisis at Metro bank as an example of what happens when a single number becomes all important.

The UK challenger bank’s latest problems started in mid-January, when it announced it had been calculating the amount of capital it needs to fund its loans in an incorrect (and falsely flattering) way.

The bank has now been forced to raise £375m in a discounted share placement to shore up its balance sheet.

Simon believes that the most important question that you can ask a management team is “what matters?” – which metric do they care about the most?

- For example, Northern Rock FD Bob Bennett used to check the 3-month money market interest rate first thing each morning.

The trouble with that is that the rate was an external metric which Bob couldn’t affect,

- He was right about the rate being important, though – it was a spike in this rate that led to Northern Rock’s problems.

Internal metrics generated by management are even more dangerous:

We should be asking how reliable that metric is and how transparent the process is for calculating it.

Investors must also wonder how much management has staked its reputation on delivering the number, and what damage might be done in the process.

Examples from history include:

- The Rentokil CEO who was known as “Mr 20%”, because he was committed to increasing earnings by this amount each year – until he couldn’t.

- Lloyds Bank and Wells Fargo, who each targeted cross-selling of products to existing customers – with predictable results (mis-selling and fake accounts).

European divergence

In the Economist, Buttonwood looked at the divergence between value and quality stocks in Europe.

- He compared Nestle (founded in 1867) with Daimler (1890).

Nestle is quality (PE = 29), Daimler is value (PE = 8).

- More importantly, the gap has been widening over the last decade.

Value doesn’t seem to work any more, as tech firms have come to dominate.

- And the value sectors have changed – from cyclicals during downturns to industries ripe for disruption (cars, banks).

In Europe, things are a bit different because there are no tech giants.

- So the winners have been “quality” stocks with stable profits, high ROCE and low debt (Nestle, Diageo, LVMH).

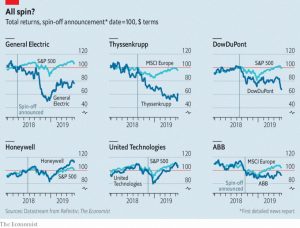

Spin-offs

The newspaper also looked at whether corporate spin-offs generate shareholder value.

- Conglomerates are out of fashion once again, and PE funds have a lot of money to buy unwanted divisions.

- Activist hedge funds are also working to restructure firms.

The article looked at six recent break-ups and concluded that only one of them (Honeywell) had gone well.

IPOs

As the Economist went to press, the recent Uber IPO had tanked by 8%.

- The newspaper speculated whether this might boost “fresh thinking on how fast-growing startups should go public“.

Since a peak in 1996 the number of publicly traded companies in America has fallen by nearly half.

Startups have been staying private as long as possible and granting shares conferring greater voting rights to their founders when they do finally go public.

In turn big private investors have pumped billions into “unicorns”, capturing most of the value they create and leaving little for investors in public markets.

The SEC has just approved the Long-Term Stock Exchange (LTSE) – based in San Francisco and backed by Marc Andreessen, Reid Hoffman and Peter Thiel.

One idea is to give longer-term shareholders more voting power.

Instead of charging for transactions or data, it will charge for add-ons that appeal to startups, says Mr Ries, such as software enabling them to track which shareholders are “tourists” moving in and out and which are “citizens of the republic”.

Details are not available, but the exchange should launch by early next year.

Robo-advisors

There were a couple of robo-advisor stories this week, neither of them good.

- I was quite optimistic about this sector when it first appeared, but the offerings have been too boring and/or expensive to catch on. (( This reminds me of P2P lending, which looked so promising 15 years ago, but which has failed to match rewards to the high risks involved, or solve the problem of tax-sheltered diversification ))

InvestEngine – which opened last week and is run by a Gumtree founder – had claimed to be the cheapest robo on the market with a flat fee of 0.45% pa.

- But there’s a fee for the underlying ETFs (average 0.17% pa) and a 0.09% trading spread.

So the real number is 0.71% – too much for me.

- Nutmeg charges 0.45% plus 0.17% plus 0.07%, so works out marginally cheaper (and is even cheaper for sums above £100K).

Evestor and PensionBee (for pension) are other cheap options.

The second story was even more gloomy – Investec has pulled the plug on their robo (called Click and Invest).

- I attended a very enjoyable promotional evening for this outfit just over a year ago, which focused on attitudes to risk.

Click and Invest is the second robo to fold, following UBS Smart Wealth.

Click and Invest lost £12.8M in the year to March 2019, following losses of £13.5M in the previous year.

- Including £6M of capitalised software, total losses are more than £30M.

The company statement said:

We are extremely proud of the service we have provided and the consistently

positive feedback we have received from clients.However, the reality has been that the appetite for investment services such as ours remains low and the market itself is growing at a much slower rate than expected.

The Times was not optimistic:

If, as is widely reported, the robos require £10bn AUM to turn a profit, there is a very long way to go; Nutmeg is leading the charge and has just gone past the £1.5bn mark.

It is likely that some firms will be incorporated into bigger, traditional, providers who wish to access their technology; an example is that of Aviva acquiring a majority stake in Wealthify in October 2017.

For me, success hinges on whether the robos can offer something that a DIY investor can’t do, or offer something that DIY investors can do, but cheaper.

- Neither is the case at the moment.

Quick links

I have seven for you this week:

- The Economist wrote about the troubles at Metro bank.

- And about US property.

- And said that riding alone in a car is an increasingly unaffordable luxury.

- Alpha Architect looked at Short Selling plus Insider Selling as a profitable strategy.

- And said that even God would get fired as an active investor.

- The Hedge Fund Journal compared Trend Following CTAs to Alternative Risk Premia.

- And Bloomberg said that the perfect bull market portfolio might have blown up your firm.

Until next time.