Weekly Roundup, 31st October 2022

We begin today’s Weekly Roundup with housing.

Housing

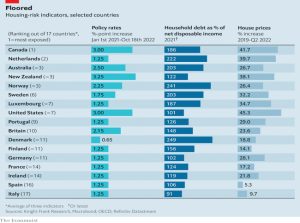

The Economist warned in two articles that a global house-price slump is coming and markets face a brutal squeeze.

- Prices are already falling in nine rich countries, and the Canadian market is already down 9%, Sweden 8% and New Zealand 12%.

UK prices are still rising (albeit more slowly than recently) though official figures are released two months in arrears.

In the US, mortgage rates (typically a 30-year fix over there) have hit 6.9%, the highest since 2002.

- With borrowing capped by the monthly repayment, buying power is down 33% in a year.

But this doesn’t mean that the US is in for a repeat of the 2007 crisis:

The country has fewer risky loans and better-capitalised banks which have not binged on dodgy subprime securities. Uncle Sam now underwrites or securitises two-thirds of new mortgages.

Which means that taxpayers will be as hard hit as homeowners.

- State insurance schemes underwrite defaults, and the Fed owns a lot of mortgage-backed securities, which fall in value as rates rise.

Other countries could fare worse, particularly China, South Korea and the Nordics.

The Economist identifies three factors to predict where there will be the most pain:

- Recent price growth (higher equals riskier)

- Borrowing levels (the UK is not doing so badly here)

- Speed of pass-through of higher interest rates to homeowners (the inverse of the average fix period)

A gummed-up property market means lower labour mobility and a stodgier jobs market.

- This is bad news under current labour conditions, but a recession next year could mask the worst of the impact.

The Economist predicts that a 20% fall in prices (greater than is predicted) would mean that 5% of mortgages (and 10% in London) were in negative equity.

And of course, lower house prices will hit consumer spending, making any recession worse.

- And as homeowners in countries with short-term fixes remortgage (and this includes the UK), we might see houses dumped on the market, making things worse.

UK rates (for five-year fixes) are now above 6% pa.

In housing corrections, and sometimes for years after, home ownership rates tend to fall, rather than rise. Economic conditions that cause house prices to fall simultaneously imperil the chances of would-be homeowners.

Unemployment rises and wages decline. If interest rates jump, people are able to borrow less and mortgage lenders tend to become more skittish about lending.

Depressed prices might sound like good news for disgruntled first-time buyers from younger generations, but higher interest rates (and lower boring limits and affordability) could keep homes tantalisingly out of reach.

From an investing point of view, profiting from a fall in house prices is far from straightforward.

- I will give it some thought and perhaps come back with an article on the topic.

Retail investors

In the FT, Madison Derbyshire and Joshua Oliver reported on data from JP Morgan showing that retail investor portfolios in the US fell by 44% from January to 18th October.

- The explanation provided is that PIs are overweight growth stocks, whose valuations fall as interest rates rise (because their cashflows are weighted further into the future).

We should also mention raging inflation and the determination of central banks to kill inflation by rising rates until we have a recession.

- But the US index is only down around 20%, so that’s not the whole story.

JP Morgan also notes that PIs are on their longest weekly selling streak since 2016.

- But the volume of selling has not reached that of March 2020, perhaps because people remember the Covid rebound.

Here in the UK, many investors will have been protected by the fall of the pound (and almost every other currency) against the dollar.

- Interactive investor (ii) says their clients have lost an average of 12% this year.

JP Morgan also noted a switch from stocks and active funds to passive trusts, and ii backed this up.

Inflation

The Economist also looked at why inflation refuses to go away.

- Spending is too high and interest rates have been too low, but things have changed.

The IMF has three reasons: shocks, wages and expectations.

- Covid messed up production and the reaction was a lot of fiscal aid.

- Consumption shifted first to goods and then back to services.

- Commodity prices went up, driven partly by Russia’s invasion of Ukraine.

- Fed rate hikes have led to a rise in the dollar, exporting inflation to other countries.

- Lockdowns constrained the labour supply, driving up wages.

So what happens next?

Much depends on what happens to inflation expectations—a third and unpredictable inflationary force. People’s beliefs about the future affect their consumption and wage bargaining.

If recent experience looms large in the formation of these beliefs, that would help to explain persistent inflation, and would complicate central bankers’ jobs.

The newspaper is not optimistic about interest rates:

Having been fooled and fooled again, central banks will not relent until the only

inflation surprises are those on the downside.

Bank of England

John Authers looked at a speech from the Bank of England’s deputy governor, Ben Broadbent, who is responsible for monetary policy.

The bottom lines are that the UK economy is in a very nasty place, and that market expectations for the progress of interest rates are too high.

The first is no surprise, but the second helps to explain the weak 0.5% rate hike from the BoE the day before the ill-fated mini-budget.

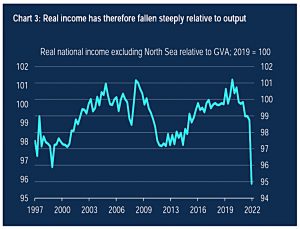

Inflation and import prices mean that real incomes have fallen.

The volume of output may have just about recovered to pre-Covid levels but its consumption value has not.

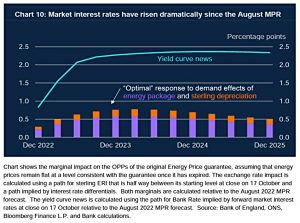

More interestingly, the BoE has very conservative calculations on how large the increase in interest rates needs to be in order to deal with:

- the weaker pound (stronger dollar)

- the inflationary impact of the energy subsidies (which free money to be spent on other things)

This is why the BoE didn’t think a 75 bps hike was needed.

- Broadbent also made it clear that a base rate of 5.25% (as predicted by the markets at one point) would mean a severe recession.

He was also clear that lower levels of fiscal stimulus from the government would mean lower interest rates were needed. (( This is obviously the case, but the only significant piece of stimulus remaining is the energy price cap, which the media were screaming for during the summer Tory leadership election ))

It will be interesting if the Fed sticks to its guns and the BoE raises rates by less.

- Lower gilt yields and lower sterling are the obvious implications.

Shaun Richards of Not A Yes Man’s Economics looked at the same speech but was more critical.

That is a pretty extraordinary intervention even for a loose cannon like Ben.After all if Bank of England economic models were reliable we would not be here would we?

It would have seen the inflationary episode on the horizon and allowed us to respond with higher interest-rates. Instead seemed to think that prices night be falling now.

Shaun took the speech to mean that the bank thinks that it’s too late for interest rate rises.

- This might be the case, but if the same model also said last year that it was too early, that’s not so great.

Ben ignores the main player right now which is that other central banks need to match the US Federal Reserve. He will do the minimum and I do not expect it to be too long before his thoughts head towards cuts in interest-rates.

In one sense this would be good news, but I’d like to see the Fed come to the same conclusion, and that might not happen for some time yet.

Transfer values

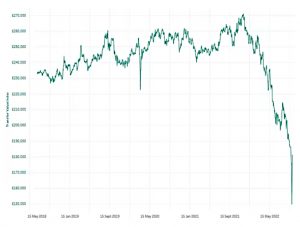

In FT Adviser, Amy Austin said that DB pension transfer values have fallen to record lows.

- This is bad news for my household, as we have a DB pension due to start in around two weeks. (( We aren’t planning a transfer out, but the 25% tax-free cash sum is based on the same calculations ))

Values were down 8% in September, and have fallen by almost a third during 2022.

- Transfer activity is low at present at 38 members per 10,000 per month.

The transfer value index is run by XPS Pensions and their spokesman Mark Barlow commented:

Pension scheme members considering a transfer will be impacted as values fall to their lowest level for almost 20 years. On the other hand, those using their transfer to secure benefits in alternative arrangements, for example annuities, will see marked improvements which may offset some or all of the fall.

He’s not wrong, but annuities remain at terrible value – my break-even age for getting back the annuity price in payouts (ignoring the opportunity cost of growing the money by investing it) is over 90.

Link

Link Fund Solutions (LFS) has been put up for sale by its Australian parent company Link Group.

- The UK subsidiary is being investigated (and likely fined) by the FCA, as well as being sued by lawyers acting for disgruntled investors in the Woodford Equity Income fund whose winding-up it supervised.

Link had previously indicated that it was unlikely to underwrite the fines and compensation (perhaps £50M and £306M respectively) that the FCA has warned it might impose on LFS.

- This FCA warning also led to a bid for Link – from Canadian firm Dye & Durham – falling through in September.

- D&D has since returned with a revised bid which excludes the UK business.

It’s understandable why Link would like to dispose of LDS, but who would want to buy with the fines hanging over it?

Quick Links

I have three for you this week:

- Mauldin Economics was Turning Bullish on Energy

- UK Dividend Stocks asked Is GSK a Good Choice for Dividend Investors?

- And Alpha Architect told us to Mind the Momentum Gap to Improve Performance.

Until next time.

Yup, CETV’s have indeed fallen significantly, I received my latest one earlier this week.

This is the first time I have ever seen anybody mention that their [up to] 25% DB PCLS is based on the CETV. In my experience DB PCLS’s are calculated using [an often published] age-related commutation rate that is generally set at each triennial valuation, although I suspect interim changes are possible.

I’m sure you know the DB rules better than me. But the cash lump sum was lower than I would have liked (or would have expected last year). If rising bond yields had nothing to do with it, that is cold comfort.

I had at one point thought that the lump sum came from 25% of the LTA value, which should be 20 x the annual pension. In which case the bond yields shouldn’t matter. In practice, the 25% of LTA holds up but the 20x doesn’t (works out at 21.1).

It’s all academic anyway since we have no control over our DB pensions (other than the years we work). Better to focus on the things we can do something about. In this case, all we can do is say yes to the 25% cash lump.

Re: “In this case, all we can do is say yes to the 25% cash lump.”

Interesting – possibly this makes sense as a HR tax-payer. But if BR payer unless you are getting an especially good commutation rate or you have private information that suggests you have a limited life span, I would think again. Does your scheme guarantee to pay out for a minimum number of years and is the spouse/survivor benefit based on the non-commuted (ie zero PCLS) value?

For info, my DB schemes commutation rates improved this year vs previous years. However, IMO they are still not even VFM.

DB schemes generally use discount rates (or other adjustments) such that your CETV is undervalued vs the technical provisions (what the scheme really thinks they need to have for you) and they also set the commutation rates such that the scheme wins (often quite handsomely) for an average member (putting aside tax considerations).

I’m sure that’s what the scheme thinks, but to me, it’s tax-free cash flow, which in decumulation (within the UK’s socialist tax regime) is a limiting factor.

And in fact, their calculations help me. The 25% they are giving me now somehow still leaves 79% of the pension available to take annually. So it will increase the value of the pension using my methods.

But even if it were not profitable in my spreadsheet, cash flow now is better. When we are in our mid-80s, we can dig into capital if we need to (but I expect we won’t need to).

Depending on the size of the PCLS keeping it tax free for the duration might be an issue. However, if you wish to use the PCLS to make a big purchase or clear a [relatively expensive] debt then this is probably not really a concern.

OTOH, a rabid socialist tax regime might of course decide to come after/close-down tax-free opportunities.

Tricky times!

It’s not so big that I can’t shelter it, though I am starting to run out of options. And I agree that things are likely to get much worse. I don’t rule out leaving the country.

Re; “leaving the country”

That is a whole other debate.

As I see it:

a) where to go is probably the first Q and do you really want to go live there; then

b) how much of your current tax advantages would you kiss goodbye to on departure

For reasons totally outside FIRE, we are currently working through staying vs an opportunity to mitigate a hefty o/seas tax bill that could be achieved by moving there. It is complicated. I suspect we will stay and take the hit – primarily because I think we can afford to do it this way. In spite of all the shxt going down we must prefer the UK; if we didn’t, we probably would have gone there years ago. And, we lived overseas before too.

Not suggesting things are bad enough yet, but I’m not optimistic about the next five to ten years, and I see the UK as more likely to punish the rich than other countries. A wealth tax or land tax would probably push me over the edge.

I know what you mean!

In some ways a worst case for us would be stay [in the UK] for another few years and then move there having paid the hefty overseas tax bill in the interim with no recourse whatsoever to recover any of it.

As I said tricky times.

One other good reason for taking a PCLS is as a risk mitigation against the scheme falling into the PPF sooner rather than later.