Weekly Roundup, 28th December 2020

We begin today’s Weekly Roundup with a look at Bitcoin.

Contents

Bitcoin

In the FT, Izabella Kaminska changed her tune on Bitcoin, deciding that maybe this time the high valuations would stick.

- Coindesk reported in mid-December that Ruffer (LON:RICA) has been buying Bitcoin during November.

The fund’s managers view the exposure as defensive rather than speculative, and replaced a similar exposure to gold.

- Bitcoin has a very low correlation with other asset classes.

The fund said:

The exposure is currently equivalent to around 2.5% of the portfolio. We see this

as a small but potent insurance policy against the continuing devaluation of the world’s major currencies.Bitcoin diversifies the company’s (much larger) investments in gold and inflation-linked bonds, and acts as a hedge to some of the monetary and market risks that we see.

The cryptocurrency remains a pretty poor medium of exchange and a pretty volatile store of value.

- But it is becoming an asset class.

Bitcoin’s value has instead become linked to something more profound: its incapacity

to go to zero despite having no central point of support or guarantor.

Izabella puts this down to hackers who demand ransom payments in crypto, just as tax authorities demand payment in their own currency.

- Bitcoin has also been recognised by many more regulators in the last few years, which paves the way for institutional involvement.

As with ESG investing, once you command sizeable institutional money, you have the power to influence the rules themselves through the threat of divestment. In bitcoin’s case, that might include changing the rules to favour censorship resistant forms of money.

Izabella sees the next step as a bitcoin debt capital market:

The irony is it’s only once the price of bitcoin stabilises [ie. after the first wave of institutional investment has inflated the price] that such a market can truly develop.

Fiat debt markets might be cheaper, but will that prove an insurmountable obstacle?

Reflation consensus

John Authers looked at the difficulties of being a contrarian at the end of 2020.

Generally, the way to make the most money in markets is by contrarian bets when you know the crowd is wrong about something. But when the consensus becomes overwhelming, contrarianism is impossible.

The current consensus is that we are in for reflation and recovery next year.

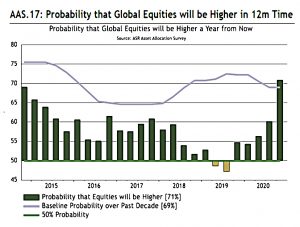

John quoted Absolute Strategy Research’s summary of the quarterly asset allocators survey:

- record high for the Survey’s “Composite Optimism Indicator”

- record probability of a stronger business cycle

- record (low) probability that US unemployment will be higher

- record probability that US IG Credit will beat Treasuries

- record probability that US HY Credit will beat IG Credit

- record probability that EM hard-currency bonds will beat HY

- record probability that Global Equities will be higher

- record probability that Global Earnings will be higher

- record (low) probability of a 20% drawdown in US equities

- record (low) probability that the USD will appreciate

- record probability that stocks will beat bonds

- record probability that Value will outperform Growth

- record probability that Cyclicals will outperform Defensives

- record probability the EM equities will beat DM equities

And Jim Paulson of the Leuthold Group’s list of sentiment measures:

Several metrics including the AAII Bulls less Bears, the put/call ratio, CNN’s Fear & Greed Index, the smart money/dumb money indicator and the investment newsletters sentiment index all suggest investor optimism has become extreme.

Historically, when sentiment reads have turned this bullish, the stock market often suffers a setback.

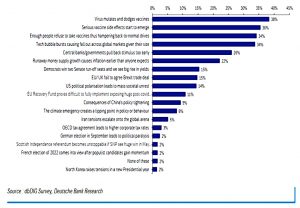

Here’s the list of risks to this consensus:

The top three are all vaccine- and virus-related.

- We now have a significant mutation, though whether it can dodge the vaccine is not known at the time of writing.

Paulsen suggests that the rise in investor sentiment since March may only represent an improvement from extreme pessimism to simple pessimism.

But John remains worried by the strong consensus.

Smart Beta

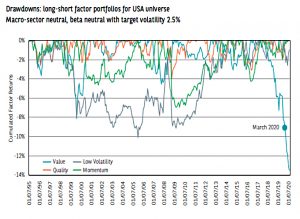

In a second newsletter, John looked at smart beta, which hasn’t been doing so well recently.

The problem this year was restricted to the value factor (buying stocks that look cheap relative to their fundamentals), and, to a lesser extent, size (buying smaller-cap stocks).

No factor until this year had ever suffered a drawdown as bad as 10%.

So John calls the Match 2020 underperformance a black swan (which was repeated in Europe, despite the absence of FAANGs).

The dreadful performance of multi-factor funds was more or less entirely a function of a biblically bad year for value. When the economy locks down for a pandemic, it turns out, companies that the market was already reluctant to hold are the worst place to be.

John hopes that this will be a one-off since there will never be another lockdown like 2020.

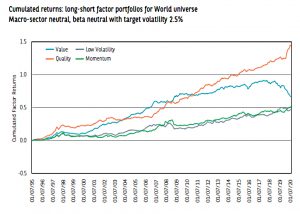

Over the long-term (25 years) the size factor has disappeared, though Research Affiliates have argued that you just need to avoid the small junk (by screening for quality).

- Multi-factors investing as a whole has done just fine, excepting this year’s value disaster.

BNP makes the positive case:

There is the strong financial rationale of investing in the cheaper (value) and less risky stocks (low risk) that are outperforming (momentum) and that have the strongest fundamentals when it comes to profitability and quality of management (quality).

It has been by empirical evidence for decades, despite the many changes we have witnessed throughout time in terms of market regimes, the way stocks are traded,

[and] technology. It [also] removes human emotion and biases from the equation.

As they note, biases are what explain factor outperformance.

CAPE revisited

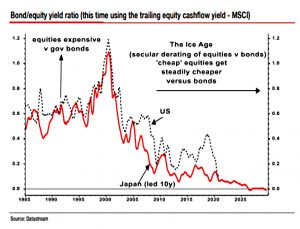

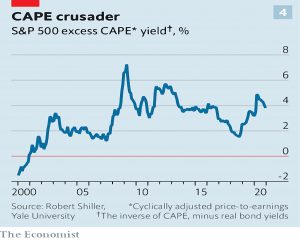

In a third newsletter, John went back to the CAPE, which we discussed a couple of weeks ago.

- It’s at historic highs in the US, but its inventor Robert Schiller has come up with a new measure (excess CAPE yield) which suggests that we don’t need to worry about this since interest rates and bond yields are so low.

Yet CAPE has been a great predictor of 10-year returns (ignoring bond yields) under other market regimes.

Albert Edwards, the SG perma-bear who predicted an ice-age for stocks, said that reading Shiller’s article made him feel “physically ill,” and compared it to a famous historically-bad call:

[Shiller’s article has] echoes of economist Irving Fisher (who coincidently was also a Yale University professor) who in early October 1929 proclaimed, “stock prices have reached what looks like a permanently high plateau” just weeks before the stock-market collapse.

John notes:

The key objection to the notion that lower bond yields justify lower equity yields is that over history they haven’t. That is because bond yields tend to be low for a reason, which is a sluggish economy.

First Japan and then Europe has seen stocks fall (in CAPE terms) along with falling bond yields.

- The US hasn’t because of the FAANG stocks.

They have hoovered up all the earnings while the rest of the U.S. stock market isn’t doing much better than Edwards predicted.

By using a 10-year lag and a trailing equity cashflow yield, Edwards gets the US curve to match Japan:

Edwards concludes:

In my Ice Age view of the world, Robert Shiller is dead wrong. In my view, US equity valuations are a QE-fueled bubble waiting to burst.

But perhaps both Edwards and Schiller are saying that stocks will do badly in the next decade, and bonds will do even worse.

Risky assets

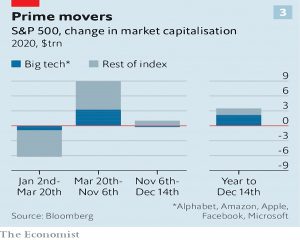

The Economist attempted to explain recent market movements.

- 2020 has been a particularly volatile year.

Stocks lost 30% of their value in a month. The yield on ten-year American Treasuries, fell by half and then by half again in a matter of days. The contract for imminently delivered barrels of American oil briefly went negative. Timber prices have fallen by half, doubled, doubled again, fallen by half once more and then doubled again.

Looking at sectors, tech boomed, then late in the year, unfashionable areas like energy and banks became popular.

The S&P is up more than 14%, pushing the CAPE to a level only exceeded in 1929 and the dot com boom.

Tech accounts for two-thirds of the S&P 500 gains and the top 5 share of the index is up to 22%.

But as we saw a couple of weeks ago, Shiller himself is not too worried.

- His new “excess CAPE yield” – which measures the attractiveness of equities relative to bonds – suggests that things have improved through the year.

Investing memories

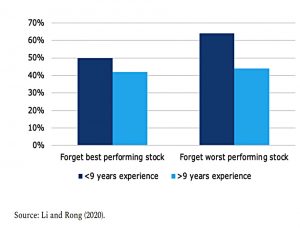

Joachim Klement looked at what investors remember.

People readily remember their best investments but have a hard time remembering their worst investments.

Which is a shame because you can learn a lot more from your mistakes.

Too many investors never learn that lesson because it is too painful for them to admit to mistakes or because after a string of mistakes they just give up.

Investors with more than 9 years of investment experience were far better at remembering their worst investments. [They] were also more likely to note down bad experiences. [They] had learned the lesson that you can improve more by remembering and examining past mistakes than past successes.

So remember to focus on your mistakes if you want to improve more quickly.

Quantum computing

The Economist looked at how quantum computing will shake up finance.

- The finance industry has a successful track record in making money from computing.

Quantum computers exploit the counterintuitive rules of quantum mechanics to produce machines which are much faster at some (though not all) computing tasks.

- Bankers believe they will be good at the things they are interested in.

Quantum quants hope their machines will boost profits by speeding up asset pricing, digging up better-performing portfolios and making machine-learning algorithms more accurate.

Arbitrage and Monte Carlo should also benefit.

But the hardware isn’t ready yet:

For many problems a quantum computer with thousands of stable qubits is provably far faster than any non-quantum machine that could ever be built—it just does not exist yet.

IBM, which has invested heavily in quantum computing, reckons it can build a 1,000-qubit machine by 2023. Both it and Google have talked of a million qubits by the end of the decade.

We probably have about five years to wait before things get interesting.

Gold standard

The Economist also looked at a new paper which suggests that a return to the gold standard would be a bad idea.

This would have required the Fed to set interest rates to maintain a fixed dollar price of gold, rather than to target inflation.

The worry is that monetary policy becomes procyclical:

- In bad times, there is a dash to gold, and the central bank would need to raise interest rates to make alternative assets more attractive.

They would also have to cut rates in good times.

- And the rate of gold production (mining) would also affect prices and hence rates.

So the gold standard would lead to greater inflation volatility and severe impacts to GDP during crashes.

Quick links

I have just two for you this week, as the financial press is largely closed for the holidays.

- The UK Value Investor has decided to build a more concentrated portfolio

- And A Wealth Of Common Sense looked at what happens when you chase the best performing funds.

Until next time.