Warren Buffett’s Annual Letters – 2021

As part of our series on Warren Buffett’s Annual Letters, we look at the letter for 2021, which was released over the weekend.

Warren Buffett’s Annual Letters – 2021

We’ve previously looked at Warren Buffett’s letters that cover:

2020, 2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009 and 2008.

Today we’ll examine the 2021 letter, which was published at the end of February.

Performance

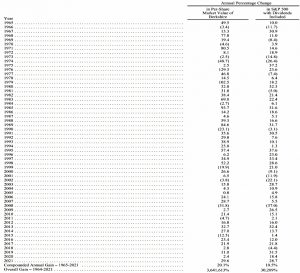

Over the 57 years to 2021, BRK has compounded its share price by 20.1% pa.

- During the same period, the S&P 500 has compounded at 10.5% pa (dividends included).

Total gains are 3.6M% for BRK and 30.2K% for the S&P – more than a thousandfold difference.

In 2021, BRK was up 29.6% whilst the S&P went up 28.7%.

Ownership

Berkshire owns a wide variety of businesses, some in their entirety, some only in part. Our goal is to have meaningful investments in businesses with both durable economic advantages and a first-class CEO.

We own stocks based upon our expectations about their long-term business performance and not because we view them as vehicles for timely market moves Charlie and I are not stock-pickers; we are business-pickers.

This year, Warren chose to focus on “four giants” within BRK: (( Last year he called them the “four jewels” ))

- The cluster of insurers, which now provide $147 bn of float to the other businesses

- Apple, of which BRK owns 5.55%

- BNSF, the railroad

- BHE, the electricity generator and distributor

Berkshire has as owners a very large corps of individuals and families that have elected to join us with an intent approaching “til death do us part.” people who are comfortable with their investments will, on average, achieve better results than those who are motivated by ever-changing headlines, chatter and promises.

Investments

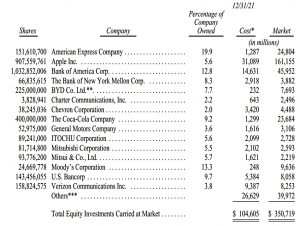

The table lists the largest 15 positions held by BRK, excluding Kraft Heinz.

- BRK is part of a control group there and accounts for the holding using the equity method.

Cash

Berkshire’s balance sheet includes $144 billion of cash and cash equivalents . Of this sum, $120 billion is held in U.S. Treasury bills, about 1of 1% of the publicly-held national debt. Charlie and I have pledged that Berkshire will always hold more than $30 billion of cash.

But not $144 bn.

Berkshire’s current 80%-or-so position in businesses is a consequence of my failure to find entire companies or small portions thereof (that is, marketable stocks) which meet our criteria for long-term holding.

This is largely because interest rates are so low.

So instead, BRK has been repurchasing shares.

When the price/value equation is right, this path is the easiest and most certain way for us to increase your wealth. During the past two years, we repurchased 9% of the shares that were outstanding at yearend 2019 for a total cost of $51.7 billion.

Numbers

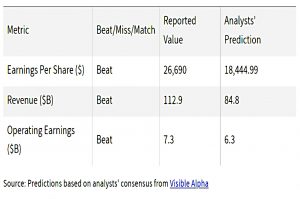

BRK beat analyst forecasts for earnings, revenues and operating earnings.

- Earnings increases in four of the five main reporting segments.

EPS was up 16% on the year.

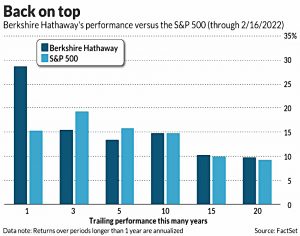

BRK is now ahead of the S&P 500 over 1, 10, 15 and 20 years (though not over 3 and 5 years).

Conclusions

It’s a fairly short and quiet letter again this year.

- There were no big deals and no mention of fashionable topics like Covid, inflation, interest rate rises, crypto or the Russian invasion of Ukraine.

He once again resisted the temptation to reduce BRK’s massive cash pile by paying a dividend.

- And there was nothing about succession planning – Greg Abel was identified as Buffett’s likely successor as CEO last May (after the annual meeting) but there is no timetable for any handover.

Maybe we’ll have better luck next year.

- Until next time.