Weekly Roundup, 4th October 2021

We begin today’s Weekly Roundup with a look at bonds.

Bonds

In the FT, Merryn Somerset Webb looked at whether the bond bull market is over and whether a bear would follow.

For the past 40 years, holding bonds has been a brilliant idea. As inflation and interest rates have generally fallen, bonds of pretty much every kind have done well.

And of course, correlations with equities have been negative, making a 60/40 portfolio perform very well.

- But rates can’t get much lower:

Back in 2000, about 80 per cent of the global bond universe yielded more than 5 per cent. Now it’s almost none. Instead, about 80 per cent of bonds yield between 0 and 3 per cent and 20 per cent have negative yields.

So if you think that interest rates will rise, perhaps you shouldn’t hold bonds.

- Deutsche Bank report that Treasures have delivered a negative real return in six of twelve decades since 1900, including four in a row from 1940.

And inflation is back – the big question is whether it’s “transitory” or not.

- A second article continued the theme, explaining that the end of a bull market need not mean the start of a bear.

Look to the Japanese government bond market as an example. Yields started to fall sharply in the early 1990s, from around 8 per cent to more like 2 per cent. During that decade the annual return came in at 9.8 per cent.

From 1999 to 2017 yields ranged between 2% and zero, with returns at 2.2% pa.

- Since then yields have been close to zero but returns have stayed positive (at just 0.3% pa, but still not a bear market).

The UK has had more inflation than Japan, meaning more reasons for rates to rise, but central banks can keep prices high (and yields low) by buying bonds in the open market.

- Something similar happened in the US between 1942 and 1951, even as inflation peaked at 20%.

Of the three scenarios, Merryn sees the last as most likely.

Most governments need to keep rates low to finance their ridiculous deficits.

I tend to agree.

- The takeaway remains not to hold government bonds unless you have to.

You could make a safe haven argument for US treasuries, but with interest rates so low, cash, commodities and real assets like property.

- Merryn also recommends the new Riuffer Diversified Return Fund.

1970s

In a third article, Merryn argues that things are starting to feel a bit like the 1970s.

- I remember the seventies, and this is not a good thing.

Amongst the signs she mentioned were:

- Higher taxes

- Higher (Conservative) government spending

- Bank of England mission creep (“the Bank is supposed to care about inflation, not climate or inequality”)

- Corporate focus on social engineering rather than profits

- Inflation

Merryn recommended a focus on income and in particular the higher-quality end of UK smaller companies.

Funds to look at include the Amati UK Smaller Companies fund and the Standard Life Smaller Companies trust.

China

Merryn’s fourth article looked at whether it was still worthwhile investing in China.

We’ve seen announcements of new rules about how Chinese kids, companies and

celebrities should behave.Tech companies that can influence public opinion have been told they must work to “spread positive energy”. Delivery companies have been hit by demands that all workers must get the local minimum wage.

The state is mandating a limit of three hours a week [for kids of] the “electronic drugs” that are video games. “Irrational fan culture”is no longer to be allowed.

The thrust is that profits for China’s tech firms are pretty low on the government’s agenda.

- And foreign luxury goods firms will also suffer as Xi Jinping regulates “excessively high incomes”.

Merryn accepts that no market is completely uninvestable:

You could argue that many Chinese equities are now cheap enough that the risk really is in the price.

But the market PE in China is 17, about the same as the UK, where there is significantly less political risk.

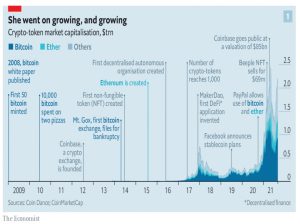

Crypto

Buttonwood explained why it would be wise to add bitcoin to an investment portfolio.

- As you might expect, it’s all about the diversification benefits, as first described by Markowitz in 1952.

Markowitz’s genius was in showing that diversification can reduce volatility without sacrificing returns. Diversification is the financial version of the idiom “the whole is greater than the sum of its parts.”

Crypto – most famously bitcoin – has high historic returns, but sky-high volatility.

- Which makes the key variable its correlation to the core of your portfolio – equities.

Since 2018 the correlation between bitcoin and stocks of all geographies has been between 0.2-0.3. Over longer time horizons it is even weaker. Its correlation with real estate and bonds is similarly weak.

If you think this will continue, then the next question is how much crypto to hold.

Across the four time periods during the past decade that Buttonwood randomly selected to test, an optimal portfolio contained a bitcoin allocation of 1-5%.

Even if one cherry-picks a particularly volatile couple of years for bitcoin, a portfolio with a 1% allocation to bitcoin still displayed better risk-reward characteristics than one without it.

In another three articles, The Economist also took a look at decentralised finance or DeFi.

- The first article concedes that there is a lot of off-putting noise in the crypto space.

The earliest adopters of bitcoin used it to buy drugs, while cyber-hackers now demand their ransom in it. Many “believers” are in reality trying to get rich quick. Others are freakishly devoted. The crooks, fools and proselytisers are off-putting.

But DeFi could be different.

- The goal is to rewire finance using a trustworthy, cheap, transparent and quick blockchain (Ethereum is the current leading candidate).

It’s hard to see incumbent financial firms (eg. global banks) and/or central bankers letting this happen.

At the moment, “gas” fees remain high if variable (they are higher when demand increases).

The basic activities taking place on DeFi are familiar. These include trading on exchanges and issuing loans and taking deposits through self-executing agreements called smart contracts.

There are also digital title deeds, the NFTs now familiar to everyone.

- The value of transactions being verified on Ethereum is now similar to that processed by Visa.

Somewhat weirder is MetaMask, a wallet that allows your avatar to roam a “metaverse” of virtual shops (amongst other things).

- An issue here is how to like the metaverse to the real world without an external store of value.

Conventional money is backed by states with a monopoly on force and central banks that are lenders of last resort.

Contract enforcement outside the virtual world is also a concern. A blockchain contract may say you own a house but only the police can enforce an eviction.

You might also choose to worry about money laundering, central control of networks and hacking.

The second article goes into much more (technical) detail.

A third article looked at new SEC chairman Gary Gensler’s plans to tame finance, and in particular, crypto.

The SEC recently threatened to sue Coinbase if it launches a lending product without first registering it as a security. {Coinbase withdrew the plan.]

And [two weeks ago] the regulator extracted $539m from three media firms charged with illegal offerings of stocks and digital assets.

Gensler is a former MIT professor who used to run a course on blockchain.

- Before that, he spent 18 years at Goldman’s and worked at the Treasury on the Sarbanes-Oxley reforms.

So crypto-believers might have expected a softer ride – instead, he described the crypto world as a:

Wild West … rife with fraud, scams and abuse.

It’s not just crypto he’s after, though – he also dislikes trading apps like Robinhood for their gamification of trading, as well as derivatives, shell companies and SPACs.

- And he wants to ban payment for order flow (Robinhood again, amongst others).

Naked Trader Interview

In the FT, Claer Barrett interviewed Robbie Burns, better known as the Naked Trader.

- Robbie’s message was that investors – particularly those who got into investing during the pandemic – need to take a longer-term approach if they want to succeed.

Robbie himself started with just £7K back in 2008 and has built that up to £3M, all within ISAs (he also uses a spread-betting account).

- His average holding period is six months.

It’s a bit like you’re going to a casino every day and expect over time to win money. The casino will take your chips. Have the patience to hold something for a while and let your money build.

Robbie also recommended using stop losses:

If a share starts to lose more than 5 or 10 per cent, I literally just sell it. I would say the reason I’ve made my millions is from having a few really big winners and then having taken lots of very small losses.

He’s not a fan of crypto, however, and is shorting bitcoin:

My view of crypto is it’s a kind of Ponzi scheme and it’s going to horribly crash.

I reviewed Robbie’s book back in 2017 – you can find the articles here.

- I didn’t get too much from the book myself, but I know lots of investors who rate it as one of their all-time favourites.

Quick links

I have five for you this week, the first two from The Economist:

- The newspaper looked at how a housing downturn could wreck China’s growth model

- And wrote about Ford and General Motors’ fight to electrify.

- UK Dividend Stocks described a 5-step approach to investing in – you guessed it – dividend stocks

- Pragmatic Capitalism explained why the Age in Bonds rule is wrong

- And Alpha Architect looked at Value Investing and Intangibles.

Until next time.