Welcome to the 7 Circles – a financial blog for the UK private investor with a long-term investment horizon.

- The goal of the website is to provide a one-stop-shop for all the information you need to look after your own finances.

Further down this page, you’ll find all the links you need to navigate around the site.

7 Circles, 9 sections

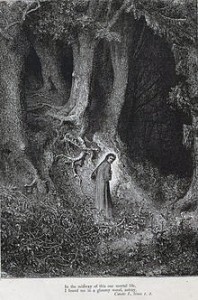

The title of the blog comes from Dante’s inferno in which Dante journeys through Hell, guided by the poet Virgil. There are actually nine circles of suffering in the poem, but seven circles of investment Hell was all I could come up with. ((And in any case, it scans better))

Let this website be your Virgil as you move through the 7 Circles of investment hell towards investment heaven:

- Understanding the Problem

- Cash and Debt

- Fire and Frugal (saving towards early retirement)

- Costs and Taxes

- Passive investment (buy and hold, asset allocation)

- Active investment (heuristics, systems and rules) &

Trading (the short-term, shorting and leverage) - How to Spend it – the decumulation phase (retirement)

More than five years since the site was founded, we now have nine main sections:

- The Basics

- Passive investing and assets

- Active Investing

- Decumulation/Retirement

- Books on Investment

- Investment Gurus

- News and Events

- Example Portfolios

- Everything else

Each of these sections is explained in more detail below.

1 – The Basics

For those new to investment, we also have the MoneyDeck series – a set of playing cards which describe 52 “golden rules” for Private Investors in the UK.

- And the Elements – a Periodic Table of all the objects you might come across during your investing career.

This series is closely linked to our Master Plan.

- This is probably the most important page on the website.

It explains all the things you need to do throughout your investing life

- And it links to the key articles that explain why and how.

- So go and take a look.

This section also includes the first four of the 7 Circles:

- Understanding the Problem

- Cash and Debt

- Fire and Frugal (saving towards early retirement)

- Costs and Taxes

2 – Passive Investing and Assets

This is number five of the 7 Circles, and it has six sub-sections:

- Passive Investing

- Assets and Asset Classes

- Diversification

- Rebalancing

- Robo-Advisors, and

- Factor Investing (Smart Beta)

3 – Active Investing

This is number six of the 7 Circles, and it has seven sub-sections:

- Fundamental Analysis

- Technical Analysis

- Market Timing

- What Works

- This includes our monthly Stock Screeners

- Tools

- A monthly series on my Trades, Tips and Funds

- And a recent series on investing during the Coronavirus pandemic

4 – Retirement / Decumulation

This is number seven of the 7 Circles, and it has four sub-sections:

- Pensions

- Drawdown

- Sequencing Risk

- Planning for the Next Generation

Retirement is the subject of one of my own books (see below) and so a lot of additional material can be found on the section for that book (Ready to Retire).

5 – Books

First, I’ve written a couple of books myself.

- You can find them on Amazon, here.

The plan is to make them part of a long series, but each book takes a few months to write, so don’t hold your breath for the rest of them.

- The first book was about behavioural investing

- And the second was about moving into retirement (decumulation).

Let me know which subject you’d like me to cover next.

Both books aim to make things a lot easier for you, the reader.

- They aren’t filled with original research, but are is intended to summarise the key findings in an area, and to turn them into useful lessons for a Private Investor in the UK today.

The point of my books – and of my blog – is to save you time and effort.

- I hope that in due course my readers will introduce me to things that I’ve missed, and help me fix those things that I’ve got wrong.

Together we can make this job a bit easier for us all.

If you’d rather buy someone else’s book on investment, we have a nifty Bookshop, which includes all my favourites and all of the books mentioned on the website.

Apart from our own books and articles, we cover a lot of key and/or popular investment books in a fair amount of detail.

These are grouped as follows:

- Simple Approaches to Investing

- UK Stock Pickers

- Box Trading Systems

- Trend Following

- Other Traders

- Required Reading

If you have a favourite book that isn’t on the list, please let us know.

6 – Gurus

As well as investment books, we also look at interviews and investor letters.

These include:

- Warren Buffett’s Annual Letters to the shareholders of Berkshire Hathaway

- The traders from the Market Wizards series

- Other Master Investors

7 – News, Events and reports

This part of the website has three main sections:

- We write a weekly roundup of all the financial news that’s relevant to the UK private investor.

- These can be found here.

- Coverage of UK Budgets can be found here.

- We try to attend the major investment events in and around London.

- Links to our reviews are provided here.

- We also try to cover the major industry reports.

- Links to our reviews are listed here.

8 – Portfolios

Over the lifetime of the blog, we’ve looked at a total of thirteen example portfolios, grouped into four categories:

- Core portfolios

- These include Mike’s own portfolio

- A VCT portfolio

- A passive ETF portfolio

- A simple 10-fund portfolio for a new investor

- Stock portfolios

- A small-cap AIM growth portfolio (SGAP)

- A main market portfolio (PiggyBack)

- A sector portfolio

- A defensive dividend portfolio

- Theme portfolios

- Investment Trusts (particularly for tech and biotech themes)

- ESG

- Smart Beta (factors)

- And Trend portfolios

Of these, six are live with real money and subject to regular performance updates on the blog:

- Mike’s portfolio

- VCTs

- SGAP

- PiggyBack

- ESG

- Factors

In response to the corona-crash, the SGAP and PiggyBack have been merged, so in the future only five portfolios will be reported on.

- In addition to these five, the Theme and MATS portfolios also hold real money. but are not reported on.

The other six portfolios are no longer active.

9 – Everything Else

As well as all the above, we also have a manifesto, plus a page of useful links to data, calculators and online tools such as portfolio managers and stock screeners.

- And as well as the eight core categories above, we also post about the psychology of investment and write the occasional opinion piece.

If you’d like to read more content relevant to the UK Private Investor – but this time from other sources – head over to our subreddit – UKFinanceOver30.

- If you’re new to Reddit, you can find out all about it here.

We also track the performance of 14 mythical 7C investors on their path to financial independence and retirement. We track three journeys:

- from age 25 to 65, with target income of £25K pa

- from age 25 to 65, with target income of £42K pa

- from age 25 to 55, with target income of £42K pa

If we divide these three journeys into 10-year stages, we derive a total of 14 snapshots, points along the way that we can analyse to see where we should be (what the portfolio size should be) and what we should be doing to stay on track.

- Each of these points corresponds to one of our 7C investors.

We hope that you find all this helpful in your journey as a private investor. If there is anything else that you would like to see on the site, please let us know.

Do you publish the the actual composition of you own portfolio? I can’t find it on you website.

Hi Hugh,

Not really – I have many hundreds of holdings and it doesn’t translate well into a blog post.

I do publish annual reviews of my performance (eg. https://the7circles.uk/portfolio-review-ten-years-gone ) but I think most people get more out of looking at themed portfolios.

I try to limit these to 50 or so stocks or funds of each type. I hold most of the stocks and funds I mention, but not necessarily in equal proportions, as per the portfolios.

I am trying to get round to making a master spreadsheet of everything I own, but when you’ve been investing for 30 years, it’s not a straightforward task. I hope to complete this as part of this year’s annual review in December / January.

I wish I had found your website a long time ago. It would have saved me a lot of time! I find it excellent