Weekly Roundup, 17th January 2017

We begin today’s Weekly Roundup in the FT, with the Chart That Tells a Story. This week it was about buy to let.

We begin today’s Weekly Roundup in the FT, with the Chart That Tells a Story. This week it was about buy to let.

It’s back to basics today, with Econ 101 – an Economics primer that paves the way for a discussion of whether Economics works as it should.

We begin today’s Weekly Roundup in the FT. where Merryn took at look at inheritance tax.

We begin today’s Weekly Roundup in the FT, with the Chart that tells a Story.

Weekly Roundup for the UK Private Investor: state pension, private pensions, IA boss ousted, corporate tax, Lloyds offer, China on AIM, Buffett after 50

We look at a new book – Postcapitalism – from Paul Mason, the economics editor of Channel 4 News. Paul says that the end of capitalism is nigh. Is he right?

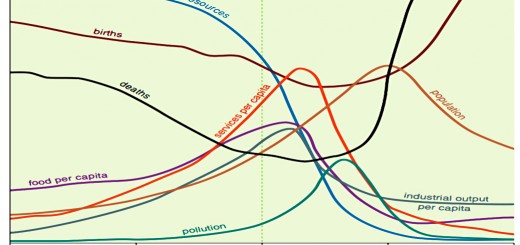

We look at the limits to growth – can the economy keep on growing for ever, or will we hit some natural constraints?

Weekly Roundup for the UK Private Investor: pensions vs earnings, VCT demand, property turnover, slow growth, US crowdfunding and income redistribution.

How much is enough? We calulate how big the retirement pot needs to be for a range of long-term DIY investors in the UK.

UK budget breakdown – income and spending

UK budget breakdown – income and spending

Becoming a Lloyd’s Name

Becoming a Lloyd’s Name

Van Tharp 7 – Stops and Exits

Van Tharp 7 – Stops and Exits

Irregular Roundup, 12th February 2026

Irregular Roundup, 12th February 2026

Mark Minervini 1 – Specific Entry Point Analysis (SEPA®)

Mark Minervini 1 – Specific Entry Point Analysis (SEPA®)

Leverage for the Long Run

Leverage for the Long Run

Stan Weinstein’s Stage System 1 – Charts and Buying

Stan Weinstein’s Stage System 1 – Charts and Buying

Freakonomics 4 – Names

Freakonomics 4 – Names

John Bender – Question Everything

John Bender – Question Everything

Annual Portfolio Review 2019

Annual Portfolio Review 2019

More

Bull markets are born on pessimism, grow on scepticism, mature on optimism and die on euphoria.