Vanguard on Portfolio Construction

Today’s post looks at a paper from Vanguard on their approach to Portfolio Construction.

Today’s post looks at a paper from Vanguard on their approach to Portfolio Construction.

Today’s post looks at a defensive strategy called the Near Perfect Portfolio.

Today’s post looks at an article by Mike Rulle of MSR Indices called The RIsk Parity Gorilla.

Today’s post looks at a note from Nicolas Rabener on the topic of using alternative ETFs to improve diversification.

Today’s post covers a recent paper from NISA Investment Advisors, which looks at building a framework to assess the performance of risk parity managers.

Today’s post looks at a long article/short book about another lazy portfolio – The Weird Portfolio.

Today’s post is a look at Engineered Portfolios – a site run by a couple of engineers with a passion for investing.

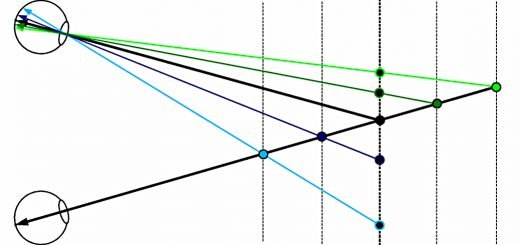

Today’s post looks at a recent joint paper from ReSolve Asset Management and Newfound Research called Return Stacking.

Today’s post looks at a paper from ReSolve Asset Management on Risk Parity Methods and Measures of Success.

Today’s post looks at a recent paper from Bridgewater on how to build a Beta portfolio in an environment that looks difficult for many assets.

Today’s post looks at a new stability portfolio from Risk Parity Chronicles.

Today’s post looks at another version of the Cockroach Portfolio, this time from Mutiny Fund.

UK budget breakdown – income and spending

UK budget breakdown – income and spending

Becoming a Lloyd’s Name

Becoming a Lloyd’s Name

Van Tharp 7 – Stops and Exits

Van Tharp 7 – Stops and Exits

Irregular Roundup, 12th February 2026

Irregular Roundup, 12th February 2026

Mark Minervini 1 – Specific Entry Point Analysis (SEPA®)

Mark Minervini 1 – Specific Entry Point Analysis (SEPA®)

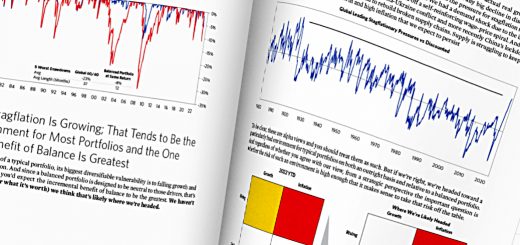

Leverage for the Long Run

Leverage for the Long Run

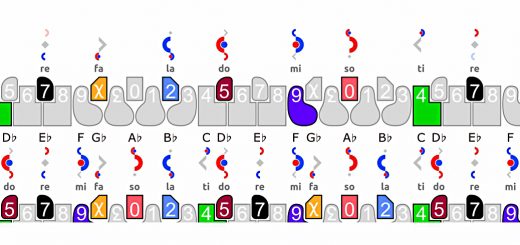

Stan Weinstein’s Stage System 1 – Charts and Buying

Stan Weinstein’s Stage System 1 – Charts and Buying

Annual Portfolio Review 2019

Annual Portfolio Review 2019

Freakonomics 4 – Names

Freakonomics 4 – Names

John Bender – Question Everything

John Bender – Question Everything

More

Good judgement comes from experience, and experience comes from bad judgement.